Market Overview: Spacetech Deals We Liked In 2024

Check out our deep dive into 65 SpaceTech deals of 2024 with $5M+ funding in the niches of asteroid mining, in-orbit transportation, satellite constellations, rocket launches, etc.

Issue 110. Subscribers 36,500.

When we talk about SpaceTech, we typically think of rockets and satellites. This is natural because now satellites provide services to various industries, and rockets help to deliver payloads to orbit. Now, from an economical point of view, the SpaceTech sector lives in an era where you need to build basic infrastructure, and many startups do that. According to an ESA report on the space economy, the annual global downstream market (services rendered by satellites) reached €358B in 2023, and the upstream market (launching services) was €53B. NASA's annual budget in 2024 was only $24.9B. These numbers are too small compared to the $103T global GDP in 2023. Even given McKinsey’s forecast of a $1.8T global space economy in 2035, we believe that in the next couple of decades, the space economy will be tightly connected with the Earth economy. Of course, like many of our readers, we at Space Ambition dream of humanity traveling across the galaxy and occupying other planets, but the reality is that if you want to build a solid SpaceTech company, you need to look for opportunities at the intersection of existing economic sectors and space technologies. The most obvious cases are Earth observation, satellite communication and Internet, or satellite navigation. But this intersection is wider and more nuanced. For example, space technologies are applied to producing mattresses, digital cameras, sneakers, baby food, and more. We hope this article will inspire both investors and founders to think out of the box when starting or investing in new SpaceTech companies.

One of the biggest problems for SpaceTech startups is raising Series A+ funding. The reason is simple. There are just too few specialized VCs investing in SpaceTech companies at later stages. They need to raise funds from generalist VCs, DeepTech VCs, corporations, or family offices, which do not always have the necessary expertise to assess their business. The good news is that such famous funds as Sequoia Capital, Kleiner Perkins, Andreessen Horowitz, Khosla Ventures, Accel, Bessemer Venture Partners, Pioneer Fund, Founders Fund, Lux Capital, General Catalyst, Insight Partners, Google Ventures, Lightspeed Ventures, and others already invest in the sector. If you want to learn more about who and why invests in SpaceTech, check out our article here. You can also read our interviews with SpaceTech VCs. If you are a generalist or DeepTech investor, we hope that our articles will help you to better understand the sector and make your first deal in 2025. If you need any help, please reach out to our co-founder Denis Kalyshkin via email at denis@spaceambition.org.

If you want to delve deeper into SpaceTech, Space Ambition co-founder Denis Kalyshkin is launching a WhatsApp group where, on a weekly basis, you will discuss trends, deals, niche specifics, etc. Join the community of like-minded people here.

We at Space Ambition do our best to provide necessary information for investors. This is why we regularly do overviews of SpaceTech deals. In this article we will cover 65 venture deals and debt financing of SpaceTech companies in 2024 with over $5M investments. We will exclude from our analysis the Chinese market since it has a lot of specifics. Such overviews should give you more examples of deals and teams which get funding. If you want to delve deeper, you can read our overviews of Series A deals in 2023 and Y Combinator portfolio. You can also learn the investment case of Rocket Lab here.

As with every startup, for success it is extremely important to consider the team of the founders, so in this article, we pay a lot of attention to the backgrounds of the founders. Of course, the majority of them have either aerospace or business development backgrounds, but there are exceptions as well. Check out our article about SpaceTech founders’ backgrounds and women in space. And if you want to pivot to SpaceTech, you can use our library and read those educational resources. We hope you will find it useful!

Moon and Deep Space Exploration Solutions

While the majority of SpaceTech startups are focused on Earth or near-Earth orbit applications, we believe that in the future, humanity will develop mining, manufacturing, energy generation, transportation, and other economic sectors in Earth orbit, on other celestial bodies, and within the asteroid belt. The reason for this is simple: if you need something in space, it is more efficient to produce it in space rather than overpaying for delivery from Earth. By the way, here’s an interesting fact for your inspiration: it requires less energy to launch satellites to LEO from the lunar surface due to its low gravity and lack of atmosphere.

In this section, we will discuss 5 deals from 2024 involving technologies for lunar and asteroid mining, building energy grids in space, and producing rocket fuel on the Moon. If you want to delve deeper, please check out our articles about asteroid mining and the investment case for Lunar Outpost.

GITAI (Japan, founded in 2016, 60 employees, total funding: $67M, last round: $15.5M in Oct 2024) develops autonomous and teleoperation robots for the International Space Station (ISS) and lunar programs. The company has a joint research contract with Toyota Motor Corporation to develop a robotic arm for the "LUNAR CRUISER." They are also among the 14 companies (including SpaceX, Blue Origin, Northrop Grumman, and Nokia) selected by DARPA for the 10-Year Lunar Architecture (LunA-10) capability study. GITAI has already successfully demonstrated lunar base construction in a mock lunar surface environment and plans to send its rover to the Moon in 2026. The company was founded by Sho Nakanose, an ambitious entrepreneur who has built and sold a company in India, ex-IBM consultant, and Singularity University graduate.

AstroForge (US, founded in 2021, 43 employees, total funding: $53M, last round: $40M in Apr 2024) offers an asteroid mining solution. Unlike its competitors, AstroForge plans to break down asteroids, refine the material, and return only the valuable elements to Earth. They launched their first space mission to test this technology in April 2023. The company was founded by Matthew Gialich (CEO), ex-Virgin Galactic and Bird, and Jose Acain (CTO), ex-SpaceX and Bird. AstroForge participated in Y Combinator’s Winter 2022 batch and is backed by Soma Capital, BBQ Capital, Pioneer Fund, Initialized Capital, and others.

Interlune (US, founded in 2020, 21 employees, total funding: $17.7M, last round: $15.5M in Mar 2024) is building a space material extraction company that extracts and commercializes space resources for Earth. The company was founded by Rob Meyerson (CEO), ex-President of Blue Origin, Indra Hornsby (COO), ex-Rocket Lab and BlackSky, and Gary Lai (CTO), ex-Blue Origin. It is backed by Gaingels, the US Department of Energy, and others.

Star Catcher (US, founded in 2024, 11 employees, total funding: $12.3M, last round: $12.3M in Jul 2024) develops a constellation of satellites to create an energy grid in space. The company was founded by Andrew Rush (CEO), ex-CEO of Redwire Space and Made In Space, Bryan Lyandvert (COO), ex-Amazon and VC, and Michael Snyder (CTO), ex-Redwire Space and Made In Space.

Starpath (US, founded in 2022, 20 employees, total funding: $12M, last round: $12M in Aug 2024) develops a solution for producing propellant from raw materials on the Moon. The company was founded by Saurav Shroff and Mihir Gondhalekar, engineers from SpaceX. It is backed by Balerion Space Ventures, Plug and Play, and others.

Space and Stratospheric Ships

While many startups are focused on launching rockets, the sector also requires other types of space and stratospheric vehicles. In this section, we will discuss startups that plan to deliver cargo back to Earth's surface, conduct experiments and production in orbit, produce stratospheric balloons, or launch space tourism initiatives.

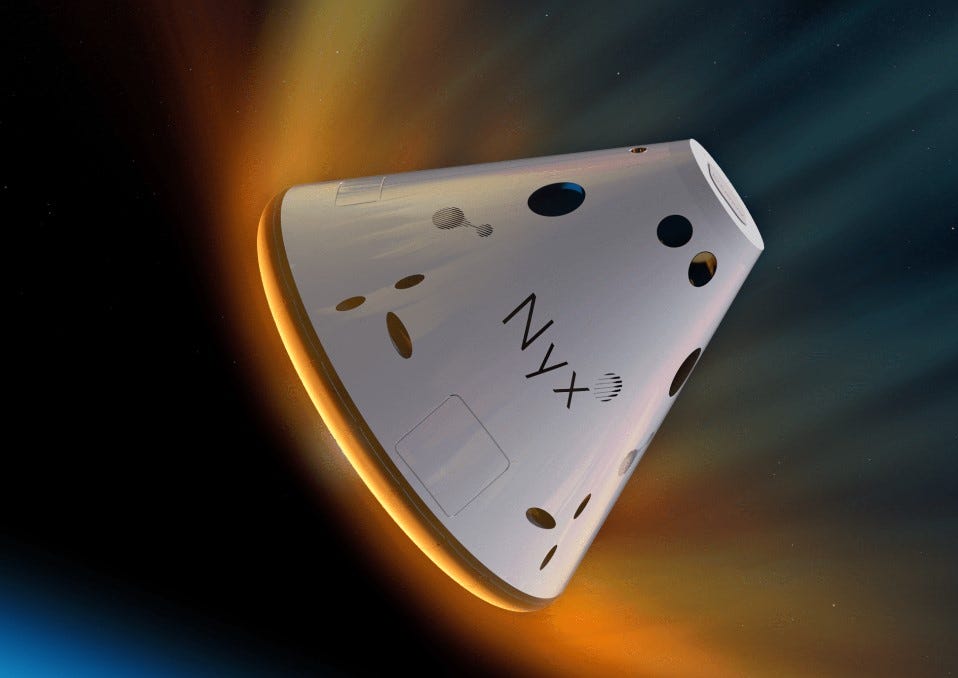

The Exploration Company (Germany, founded in 2021, 188 employees, total funding: €196.8M, last round: €150M in Nov 2024) develops, manufactures, and operates modular, reusable spaceships for space station services. The company was founded by Hélène Huby (CEO), founder and partner at Urania Ventures, and ex-Airbus and ArianeGroup; Artur Koop (COO), ex-Airbus and NASA; Nils Bernhardt (Lead Software), ex-founder of a startup and Airbus engineer; and Sebastien Reichstadt (Lead Propulsion Systems), ex-ArianeGroup. The company is backed by EQT Ventures, Schlumberger, and others.

Varda (US, founded in 2021, 121 employees, total funding: $141M, last round: $90M in Apr 2024) is a space manufacturing startup focused on creating products in space for terrestrial applications. The company aims to build infrastructure to harvest materials for new products in space through asteroid mining. They plan to manufacture pharmaceuticals, fiber optics, and other materials with properties optimized by space conditions. Varda was founded by Will Bruey (CEO), co-founder and Partner at Also Capital, ex-SpaceX, and Bank of America Merrill Lynch; Delian Asparouhov (President), Partner at Founders Fund, ex-Principal at Khosla Ventures, ex-YC startup founder; and Daniel Marshall (Chief Scientist). It is backed by Khosla Ventures, Lux Capital, Founders Fund, General Catalyst, Air Force Research Laboratory, and others.

Sceye (US, founded in 2014, 49 employees, total funding: $50M, last round: undisclosed in Sept 2024) has developed stratospheric airships capable of flying at 65,000 feet (20 km) for year-long missions. These airships are equipped with cameras, sensors, hyperspectral imaging, radar, and communications infrastructure. The company was founded by Mikkel Vestergaard Frandsen (CEO).

Inversion Space (US, founded in 2021, 68 employees, total funding: $54.1M, last round: $44M in Nov 2024) is developing autonomous reentry vehicles designed to deliver cargo from space to Earth. The company was founded by Justin Fiaschetti (CEO), Forbes 30U30, with aerospace experience at SpaceX, Relativity Space, and GE Aviation, and Austin Briggs (CTO), an aerospace engineer with 6 years of experience. Inversion Space participated in Y Combinator’s Summer 2021 batch. The company is backed by Lockheed Martin Ventures, FundersClub, and others.

World View Enterprises (US, founded in 2012, 166 employees, total funding: $73.9M, last round: $25M in May 2024) develops stratospheric balloons for remote sensing. The company was founded by Jane Poynter (CEO) and Taber MacCallum (CTO), serial SpaceTech entrepreneurs with 21+ years of experience working together. It is backed by Accel, Space Capital, and others.

Unastella (South Korea, founded in 2022, 8 employees, total funding: $19M, last round: $14.6M in Sept 2024) is developing a spacecraft for suborbital tourist flights above 100 km. The company was founded by Jae Park, a lecturer at Technische Universität Berlin and ex-German Aerospace Center (DLR), with experience at other SpaceTech companies.

Earth Observation Constellations

Earth observation constellations provide valuable solutions across various industries, which is why we regularly publish articles exploring different aspects of this market. We've already discussed how Earth observation supports greenhouse gas monitoring (Article 1, Article 2), agriculture, crime prevention, and other critical use cases. Additionally, we’ve conducted a deep dive into the top-funded Earth observation constellation companies.

In 2024, we identified 10 VC deals and 1 debt financing exceeding $5M directed toward Earth observation startups. These companies employ diverse sensor technologies—including Synthetic Aperture Radar (SAR), hyperspectral imaging, thermal imaging, and radio frequency monitoring—to capture and analyze images of Earth.

ICEYE (Finland, founded in 2014, 669 employees, total funding: $471M, last round: $158M in Dec 2024) develops Synthetic Aperture Radar (SAR) satellite imaging solutions for the maritime, disaster management, insurance, and finance sectors. The company was founded by Rafal Modrzewski and Pekka Laurila. ICEYE began commercial operations in 2019 and has since launched 38 satellites. It is backed by Seraphim Capital, Space Capital, OTB Ventures, and others.

Unseenlabs (France, founded in 2015, 77 employees, total funding: €112M, last round: €85M in Feb 2024) operates a constellation of 15 6U CubeSats that monitor the Earth using radio frequencies. Their first satellite was launched in August 2019. Unseenlabs serves the maritime, civil government, offshore energy, and insurance sectors. The company was founded by Clément Galic and Jonathan Galic.

Muon Space (US, founded in 2021, 127 employees, total funding: $91.7M, last round: $56.7M in Aug 2024) builds low-cost hybrid launch vehicles for small satellites. The company was founded by Jonathan Dyer (CEO), Pascal Stang (CTO), Paul Day, Reuben Rohrschneider, Dan McCleese, all with previous experience at Google, Apple, Lyft, and NASA. It is backed by Space Capital, among others.

Pixxel (India, founded in 2019, 265 employees, total funding: $95M, last round: $24M in Dec 2024) builds a hyperspectral satellite constellation. The company was founded by Awais Ahmed (CEO) and Kshitij Khandelwal (CTO), both from the Hyperloop India founding team. Pixxel is backed by Lightspeed Ventures, Techstars, and others.

Albedo (US, founded in 2020, 75 employees, total funding: $93M, last round: $35M in Jan 2024) operates a high-resolution visible and thermal spectrum Earth observation constellation in Very Low Earth Orbit (VLEO). The company was founded by Topher Haddad (CEO), Winston Tri (CPO), and AyJay Lasater (CTO), all with experience at Lockheed Martin and Facebook. Albedo participated in Y Combinator’s Winter 2021 batch.

LeoLabs (US, founded in 2016, 105 employees, total funding: $111M, last round: $29M in Feb 2024) builds Low Earth Orbit mapping and space situational awareness services. The company was founded by Daniel Ceperley (CEO) and Edward T. Lu (CTO), both with experience at NASA and Google. It is backed by Seraphim Space, Insight Partners, Space Capital, Airbus Ventures, and others.

Here is a list of other $5M+ deals in the niche:

Orbital Sidekick (US, founded in 2016, 38 employees, total funding: $55.4M, last round: $8.6M in Nov 2024) develops a hyperspectral Earth observation constellation.

SatVu (UK, founded in 2016, 53 employees, total funding: £41.3M, last round: £10M in Nov 2024) develops high-resolution thermal Earth observation constellations.

Wyvern (Canada, founded in 2018, 48 employees, total funding: $18.6M, last round: $6M in Oct 2024) develops a hyperspectral Earth observation constellation.

GalaxEye (India, founded in 2020, 95 employees, total funding: $13.6M, last round: $10.1M in 2024) develops a multi-sensor (SAR + MSI) imaging satellite constellation.

Debt financing

HawkEye 360 (US, founded in 2015, 182 employees, total funding: $412.3M) secured $40M in debt financing in April 2024. The company operates 10 clusters of compact satellites, each consisting of three satellites, orbiting the Earth at altitudes between 400 and 600 kilometers. These satellites use the radio frequency spectrum to image the Earth. HawkEye 360 offers services in defense, maritime operations, and global protection, addressing challenges such as illegal fishing, poaching in national parks, and emergency response. The company was founded by Chris DeMay, Charles Clancy, and Bob McGwier. It is backed by BlackRock, Space Capital, Lockheed Martin Ventures, Airbus, Insight Partners, Esri, and SVB Capital.

Satellite Internet, IoT, and Other Communication Solutions

In our previous articles, we’ve delved deeply into the niches of Satellite Internet and Satellite IoT. These sectors are already dominated by major players, making venture capital investments in new startups relatively rare. In 2024, we identified only 4 VC deals exceeding $5M in this space, highlighting the cautious approach of investors toward backing emerging companies in this competitive landscape.

Astranis (US, founded in 2015, 433 employees, total funding: $753.5M, last round: $200M in July 2024) develops low-cost internet solutions via geostationary satellites for commercial and governmental needs. Over the past two years, the company has sold nearly $1B worth of services. It was founded by John Gedmark (CEO), who previously co-founded the Commercial Spaceflight Federation and served as the Director of Flight Operations at the X Prize Foundation, and Ryan McLinko, a former Spacecraft Engineer at Planet Labs. Astranis participated in Y Combinator’s Winter 2016 batch and is backed by Andreessen Horowitz, BlackRock, Soma Capital, and others.

Lumen Orbit (US, founded in January 2024, 9 employees, total funding: $13.9M, last round: $1M in October 2024) focuses on building data centers in space. The company was co-founded by Philip Johnston (CEO), a former McKinsey consultant and ex-founder of Opontia, a startup that raised $62M before being acquired. Lumen Orbit is backed by Sequoia Capital, NFX, Plug and Play, and Soma Capital. Fun fact: we at Space Ambition predicted this startup would raise $10M+ after seeing them in the batch. Our assumption was based on their strong team, unique use case, and $2.4M pre-seed round raised before acceleration. It’s always satisfying to see accurate forecasts!

FOSSA Systems (Spain, founded in 2020, employees, total funding: €7.1M, last round: €6.3M in June 2024) specializes in cost-effective satellite IoT solutions for industrial applications. The startup was founded by Julián Fernández (CEO), a Forbes 30 Under 30 honoree with over three years of aerospace experience, and Vicente González Negro (COO), also a Forbes 30 Under 30 recipient.

ATLAS Space Operations (US, founded in 2015, 44 employees, total funding: $52M, last round: $15M in September 2024) offers a global ground network enabling operators to access space through any ground station. It was founded by Sean McDaniel (CEO), a former Northrop Grumman engineer and US Air Force officer; Mike Carey (COO), a former US Air Force officer and ex-CEO of a public SpaceTech company; and Brad Bode (CTO), a former Software Engineer at Northrop Grumman.

Satellite Manufacturing and Other Satellite Constellations

In this subsection, we highlight 5 companies that raised over $5M in funding in 2024. These startups either provide satellite manufacturing services or are building unique satellite constellations. One of the most unusual companies in this group is Reflect Orbital, backed by Sequoia Capital. Reflect Orbital aims to use in-space reflectors to "sell sunlight" for commercial applications. It will be fascinating to follow this startup's progress in the coming years.

Orbitworks (UAE, founded in 2024, total funding: $100M, last round: $100M in August 2024) is a joint venture between Marlan Space and Loft Orbital, established to produce satellites for the MENA region.

K2 Space (US, founded in 2022, 87 employees, total funding: $65.5M, last round: $50M in February 2024) develops large satellites for military and other applications. It was founded by Karan Kunjur (CEO), a former BCG consultant and INSEAD alumnus, and Neel Kunjur (CTO), a former Avionics Engineer at SpaceX. The company is backed by First Round Capital, Alpine Space Ventures, and others.

NaraSpace Technology (South Korea, founded in 2015, 37 employees, total funding: $22.7M, last round: $15M in May 2024) specializes in the design, development, integration, and testing of CubeSats and small space systems. It is supported by Samsung Securities, Korea Development Bank, and other investors.

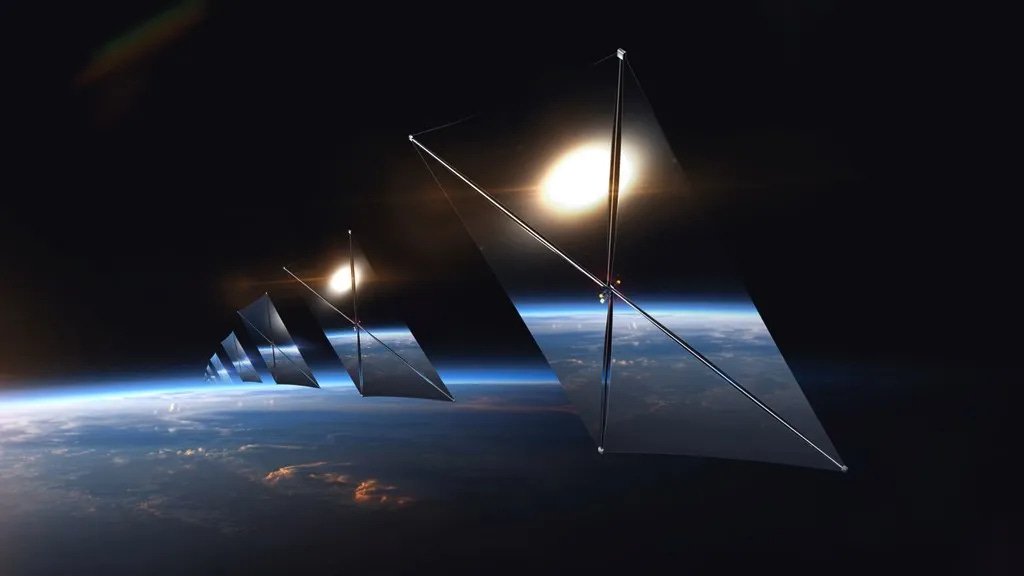

Reflect Orbital (US, founded in 2021, 20 employees, total funding: $8.7M, last round: $6.5M in 2024) is developing a constellation of in-space reflectors designed to sell sunlight for commercial applications. The company was founded by Ben Nowack (CEO) and Tristan Semmelhack (CTO), formerly of Zipline, and is backed by Sequoia Capital and others.

XDLINX Space Labs (India, founded in 2022, 71 employees, total funding: $7M, last round: $7M in October 2024) focuses on the production of CubeSats. The company was founded by Rupesh Gandupalli (CEO) and Govindhasamy Karthik (CTO), who bring prior experience from Planet Labs, Apple, Microsoft, Applied Materials, and Thales. It is backed by E2MC and other investors.

In-orbit Transportation, Refueling, De-orbiting, and Debris Removal Startups

Space debris, orbit maneuvering, in-orbit transportation, and deorbiting are becoming increasingly urgent challenges. In 2024, we identified 13 VC deals and 2 debt financings exceeding $5M for startups tackling various aspects of this growing problem. These companies are innovating across multiple fronts: some are developing low-thruster engines (explored in our previous article), while others focus on in-orbit transportation, satellite refueling and inspection, or space debris monitoring solutions.

We frequently delve into different aspects of this evolving market. For a deeper understanding of the Kessler Syndrome, you can explore our dedicated article here. We've also covered topics like space traffic management and deorbiting technologies in detail. Looking ahead, we plan to explore additional dimensions of this critical industry—so stay tuned for more insights!

Impulse Space (US, founded in 2021, 174 employees, total funding: $225M, last round: $150M in October 2024) develops orbital maneuvering vehicles for last-mile cargo delivery to low Earth orbit, geostationary orbit, the Moon, and Mars. The company plans its first refueling mission in 2025 and aims to launch its first commercial mission to Mars in 2026. It was founded by Tom Mueller (CEO), the former Propulsion CTO at SpaceX with 18+ years of experience. Impulse Space is backed by Founders Fund, Space Capital, Lux Capital, Alumni Ventures, Airbus, Balerion Space Ventures, and others.

D-Orbit (Italy, founded in 2011, 389 employees, total funding: $198.3M, last round: $50M in 2024) builds low-cost hybrid launch vehicles for small satellites. It was founded by Luca Rossettini (CEO), who has extensive aerospace experience, and Renato Panesi (Chief Commercial Officer), with 12 years in the aerospace sector. The company is backed by Seraphim Space, Primo Capital, and others.

Starfish Space (US, founded in 2018, 70 employees, total funding: $63M, last round: $29M in November 2024) develops autonomous space vehicles for in-orbit satellite servicing missions. It was founded by Austin Link and Trevor Bennett, who previously worked at NASA, Blue Origin, and Lockheed Martin. Starfish Space is backed by Seraphim Space, NFX, NASA, Toyota Ventures, Creative Destruction Lab, and others.

Benchmark Space Systems (US, founded in 2017, 64 employees, total funding: $55.7M, last round: $6.8M in May 2024) designs and manufactures turn-key chemical, electric, and hybrid propulsion systems for CubeSats. It was founded by Ryan McDevitt (CEO) and Matthew Shea (CPO).

Pale Blue (Japan, founded in 2020, 22 employees, total funding: $35.5M, last round: undisclosed Series B in June 2024) develops water-based propulsion systems and satellite mobility infrastructure for the aerospace industry. The company was founded by Jun Asakawa (CEO), Kazuya Yaginuma, Yuichi Nakagawa, and Hiro Koizumi, all of whom are affiliated with The University of Tokyo as Project Assistant Professors and Researchers.

Turion Space (US, founded in 2020, 70 employees, total funding: $27.8M, last round: $20M in December 2024) is developing spacecraft for in-orbit transportation and inspection. The company was founded by individuals with experience at SpaceX and Lockheed Martin and participated in the Summer 2021 batch of Y Combinator.

Other $5M+ Deals in the Niche:

ION-X (France, founded in 2021, 19 employees, total funding: €13M, last round: €13M in December 2024) develops a 1U plug-and-play thruster using a non-toxic and non-pressurized propellant.

Infinite Orbits (France and Singapore, founded in 2017, 55 employees, total funding: €14.3M, last round: €12M in May 2024) provides satellite maintenance, orbit correction, and de-orbiting services for geostationary operators.

Aldoria (France, founded in 2017, 52 employees, total funding: €10M, last round: €10M in January 2024) offers a solution for space debris monitoring and collision avoidance in low Earth orbit, utilizing a network of ground stations across the globe.

ExoTerra (US, founded in 2011, 95 employees, total funding: $9.5M, last round: $8M in June 2024) develops electric propulsion systems for space applications.

Argo Space (US, founded in 2021, 18 employees, total funding: $9.9M, last round: $7.9M in October 2024) is developing a transportation spacecraft designed to carry satellites and other payloads to LEO, MEO, GEO, and lunar orbits.

DARK (France, founded in 2021, 50 employees, total funding: $10.9M, last round: €5.6M in April 2024) is building a solution for emergency debris removal using transportation spacecraft launched from aircraft.

Aliena (Singapore, founded in 2018, 14 employees, total funding: $6.7M, last round: $5.6M in March 2024) develops electric propulsion systems for satellites.

Debt financing

Slingshot Aerospace (US, founded in 2017, 148 employees, total funding: $148.9M) secured $30M in debt financing in September 2024. The company provides space orbit tracking and data analytics for satellite and debris monitoring. It was founded by David Godwin (CEO), an investor at ATX Venture Partners; Thomas Ashman (Director of Operations), a former Division Chief for Intelligence, Surveillance, and Reconnaissance Operations in the US Air Force; and Melanie Stricklan (Chief Strategic Officer), a former US Military Officer. Slingshot Aerospace is backed by Lockheed Martin Ventures and Techstars.

Phase Four (US, founded in 2015, 46 employees, total funding: $35.8M) secured $6.3M in debt financing in March 2024. The company develops electric propulsion systems for satellites. It was founded by Simon Halpern, a second-time SpaceTech founder and former Team Lead at Northrop Grumman. Phase Four is backed by Lightspeed Venture Partners.

Old Good of Space Launch Business

Based on our discussions with SpaceTech VCs, many of them avoid investing in launch companies due to the high level of competition and the risk of many players going bankrupt. However, in 2024, we identified 9 VC investments and 3 debt financings exceeding $5M for launch companies around the world. Most investors are either focused on supporting local players in various regions or developing reusable rockets for a variety of applications. Some solutions are centered around building rocket engines. Only SpinLaunch, Longshot Space Technologies, and EtherealX have raised funding this year to challenge the traditional approach to space launches. Of course, Starship is set to become a game changer in this field. To understand its potential impact, check out our article here. We’ve also conducted deep dives into the evolution of jet propulsion and whether humanity is stagnating in space launch technologies. Additionally, we’ve explored how rocket technology works and analyzed the impact of rocket launches on climate change in our other articles.

Firefly Aerospace (US, founded in 2014, 700 employees, total funding: $746.6M, last round: $175M in November 2024) provides launch services to various orbits, including lunar missions. The company was founded by Thomas Markusic (CEO), a former engineer at NASA, SpaceX, Blue Origin, and Virgin Galactic; PJ King, a former CEO with 14+ years of experience; and Michael A. Blum, an experienced entrepreneur, manager (including at PayPal), and investor. Firefly Aerospace went bankrupt and was reorganized in 2017. You can read their full story here.

X-Bow Launch Systems (US, founded in 2016, 151 employees, total funding: $159.8M, last round: $70M in July 2024) develops solid rocket motors and hypersonic technologies for commercial and government payloads. The company was founded by Jason Hundley (CEO), a former engineer at NASA and Northrop Grumman; Mark Kaufmann (Senior Vice President), ex-Aerojet Rocketdyne; Maureen Gannon (CRO); and John Leary (General Counsel), who previously worked at Firefly Rocket Systems, Virgin Galactic, and Ford Models. X-Bow is backed by Lockheed Martin Ventures, Boeing HorizonX Ventures, Balerion Space Ventures, and others.

Isar Aerospace (Germany, founded in 2018, 396 employees, total funding: $440.3M, last round: €65M in June 2024, venture debt: $20M in June 2024) provides launch services for small and medium-sized satellites (up to 1,000+ kg payloads to low Earth orbit), serving the European market. The company was founded by Daniel Metzler (CEO), a former Project Lead at WARR, and Josef Fleischmann (COO). Isar Aerospace is backed by Airbus Ventures, Porsche SE, and others.

Gilmour Space Technologies (Australia, founded in 2012, 181 employees, total funding: $168.2M, last round: $34M in February 2024) develops low-cost hybrid launch vehicles for small satellites. The company was founded by Adam Gilmour, a former Managing Director at Citi Group with 20+ years of experience. Gilmour Space Technologies is backed by 500 Global, the Australian Government Department of Defence, and the Department of Industry, Innovation, and Science, among others.

SpinLaunch (US, founded in 2014, 53 employees, total funding: $161.5M, last round: $11.5M in November 2024) uses a centrifuge spinning at high speeds inside a vacuum chamber to launch rockets into space. The company was founded by Jonathan Yaney (CEO) and Maximus Yaney, a serial SpaceTech entrepreneur whose previous company was acquired by Google. SpinLaunch is backed by Kleiner Perkins, Google Ventures, Airbus Ventures, Alphabet, and others.

Orbex Space (UK, founded in 2015, 237 employees, total funding: $134.5M, last round: £16.7M in April 2024) develops low-cost, reusable hybrid launch vehicles for small satellites. The company was founded by Chris Larmour (CEO), who has 10+ years of sales and marketing experience, and Kristian von Bengtson (Chief Development Officer), a second-time SpaceTech founder.

Interstellar Technologies (Japan, founded in 2013, 46 employees, total funding: $61M, last round: $25M in October 2024) specializes in miniature rockets for low-cost satellite launches. The company has successfully launched 18 rockets to date.

Other $5M+ Deals in the Niche:

Longshot Space Technologies (US, founded in 2020, 18 employees, total funding: $6.5M, last round: $5M in April 2024) develops hypersonic rockets for cost-efficient payload launches.

EtherealX (India, founded in 2022, 34 employees, total funding: $5M, last round: $5M in August 2024) is working on a fully reusable medium-lift launch vehicle with vertical landing capabilities.

Debt financing

ABL Space Systems (US, founded in 2017, 178 employees, total funding: $479M) secured $20M in debt financing in April 2024. The company develops low-cost, reliable rockets designed for small satellite payloads. It was founded by Harry O'Hanley (CEO), a former Lead Propulsion Engineer and Manager at SpaceX, and Daniel Piemont, a former research engineer at First Round Capital and Redpoint Ventures. ABL Space Systems is backed by Lockheed Martin Ventures.

PLD Space (Spain, founded in 2011, 262 employees, total funding: €95.8M) secured €31.2M in debt financing in July 2024 and an additional €11M in December 2024. The company specializes in developing low-cost, reusable rockets. It was founded by Raúl Torres (CEO) and Raúl Verdú (CBDO) shortly after their university graduation. PLD Space has been supported by Horizon 2020 and ESA Business Applications.

Isar Aerospace also secured $20M in debt financing in June 2024.

Components, Engineering Tools, and Assembly Processes

Satellites, rockets, and other SpaceTech solutions are often produced in small batches or custom-assembled. We believe there is significant potential for optimization and standardization in both the components and production processes. As a result, we anticipate that more startups will emerge in this niche in the coming years. In 2024, we identified only 7 deals with $5M+ funding that focus on producing components, satellite buses, radiation-tolerant electronics, and similar solutions.

Hadrian (US, founded in 2020, 182 employees, total funding: $216.5M, last round: $92M in February 2024, venture debt: $25M) builds autonomous, software-defined precision component factories that enable customers to manufacture rockets, satellites, jets, and eVTOLs. The company was founded by Chris Power, the former founder and managing partner of ADSC, a mid-market acquisition fund focused on the aerospace and defense supply chain. He also has experience in general management, sales, partnerships, and product management. Hadrian is backed by Andreessen Horowitz, Founders Fund, Lux Capital, and others.

CesiumAstro (US, founded in 2017, 235 employees, total funding: $185.2M, last round: $65M in June 2024) develops out-of-the-box communication systems for satellites, UAVs, launch vehicles, and other space or airborne platforms. The company was founded by Shey Sabripour, former CTO of Firefly Aerospace (2.5 years) and Director of Spacecraft Design at Lockheed Martin (23+ years). CesiumAstro is backed by Kleiner Perkins, Airbus Ventures, Honeywell Ventures, L3 Harris Technologies, the Development Bank of Japan, and others.

Apex (US, founded in 2020, 89 employees, total funding: $122M, last round: $95M in June 2024) manufactures small satellite bus models ranging from 100 to 500 kg. The company was founded by Ian Cinnamon, a Stanford alumnus and former founder of Synapse Technology Corporation (which raised $6M before being acquired by Palantir Technologies). Apex is backed by Andreessen Horowitz, CRV, Toyota Ventures, and others.

TEKEVER (Portugal, founded in 2001, 451 employees, total funding: €90M, last round: €70M in November 2024) specializes in drones, AI platforms for surveillance, synthetic aperture radars, and satellite communication subsystems. While not a traditional startup, TEKEVER has recently received significant funding. It is backed by the NATO Innovation Fund and others.

Geminus (US, founded in 2018, 34 employees, total funding: $22.9M, last round: $13M in January 2024) develops an AI platform designed to empower engineers, industrial operators, and machines to make fast, confident decisions across the oil & gas, aerospace & defense, semiconductor, and energy industries. The company was co-founded by Greg Fallon (CEO), a former VP of Product at Autodesk (5+ years) and Sales & Marketing executive at ANSYS (6+ years); Kamesh Raghavendra, a product manager at The HIVE (10+ years) and board member of several startups; and Karthik Duraisamy (Chief Scientist), an aerospace professor at the University of Michigan and former assistant professor at Stanford.

Overview Energy (US, founded in 2022, 16 employees, total funding: $18.5M, last round: $11.7M in July 2024) is a stealth-mode startup developing conversion technologies and management systems to optimize energy consumption.

Novo Space (Argentina, founded in 2019, 30 employees, total funding: $6.8M, last round: $6.8M in January 2024) develops high-performance, radiation-tolerant, modular electronics for space missions.

Debt financing

Zeno Power (US, founded in 2018, 56 employees, total funding: $44.9M) secured $8M in venture debt in June 2024. The company develops commercial radioisotope power systems (RPSs) for NASA and the Department of Defense. The startup has previously been backed by Tribe Capital, 1517 Fund, AIN Ventures, Balerion Space Ventures, and DCVC.

Hadrian also secured $25M in debt funding in February 2024.

We hope this deal overview will inspire you to contribute to the SpaceTech sector in 2025. We hail those of you who are ready to venture on a quest of launching a startup or investing in one. If you have already started, check out the list of SpaceTech accelerators, and conferences that could be instrumental in your journey. Also join our community in WhatApp.

We’d like to finish with a quote from Mark Watney from “The Martian”: “This is space. It doesn’t cooperate.” This is equally true for startup founders and investors who operate in the aerospace sector because it’s so hard to raise money for deep tech. This is why we are happy to see the heroes who continue their journey and succeed despite the headwinds. We at Space Ambition will be here for you in 2025, so if you need any assistance or you have any idea, please, shoot us an email via denis@spaceambition.org. We will do our best to help you.

Lots of really compelling activity in propulsion with tremendous upside to be captured.

I completely agree that intersecting existing industries with space technologies is key to unlocking the next phase of the space economy. The sports industry, one of the largest on Earth, has incredible untapped potential in space.

My dream is to work for NASA and develop Space Sports, a field that could inspire global unity, enhance astronaut health, and create entirely new markets. I’ve even written a Blueprint detailing a strategy to make this a reality. Starting with unmanned competitions like rocket racing, Space Sports could evolve into team-based games on the Moon or Mars, bringing public excitement and engagement to space exploration.

I’d love your thoughts on how best to connect with the brilliant people at NASA to encourage them to consider Space Sports in their plans. Thank you for this insightful article. It reinforces my belief that SpaceTech and Space Sports could become some of the greatest industries of our time!