The Who and Why of Spacetech Investments

Global investments abound, driven by returns or missions. Spacetech interest is soaring, and VC investments are accelerating. Discover top spacetech VCs.

Issue 78. Subscribers 11 212.

If you're looking to launch a spacetech startup or transition into the spacetech sector, join our fellowship program that starts on April 12. Learn more and register here.

From an investment perspective, spacetech falls under a broader classification segment – deeptech investments. The complexity associated with deeptech, and spacetech in particular, derived mainly from the tech aspect of the term. Investing in deeptech requires a significant level of expertise in the subject matter, making it less popular and perceived as riskier compared to other segments. Spacetech is often regarded as one of the most challenging sectors within deeptech.

We used data from the E&Y VC dashboard for the above graph.

Despite these challenges, deeptech investments grew by nearly 300% for the last 10 years, and now represent a solid 20% of the total VC investments globally. At the same time, the space segment investments almost returned to the level of 2014. Nonetheless, there are numerous venture capital firms that are either considering spacetech deals or have even specialized in spacetech investments.

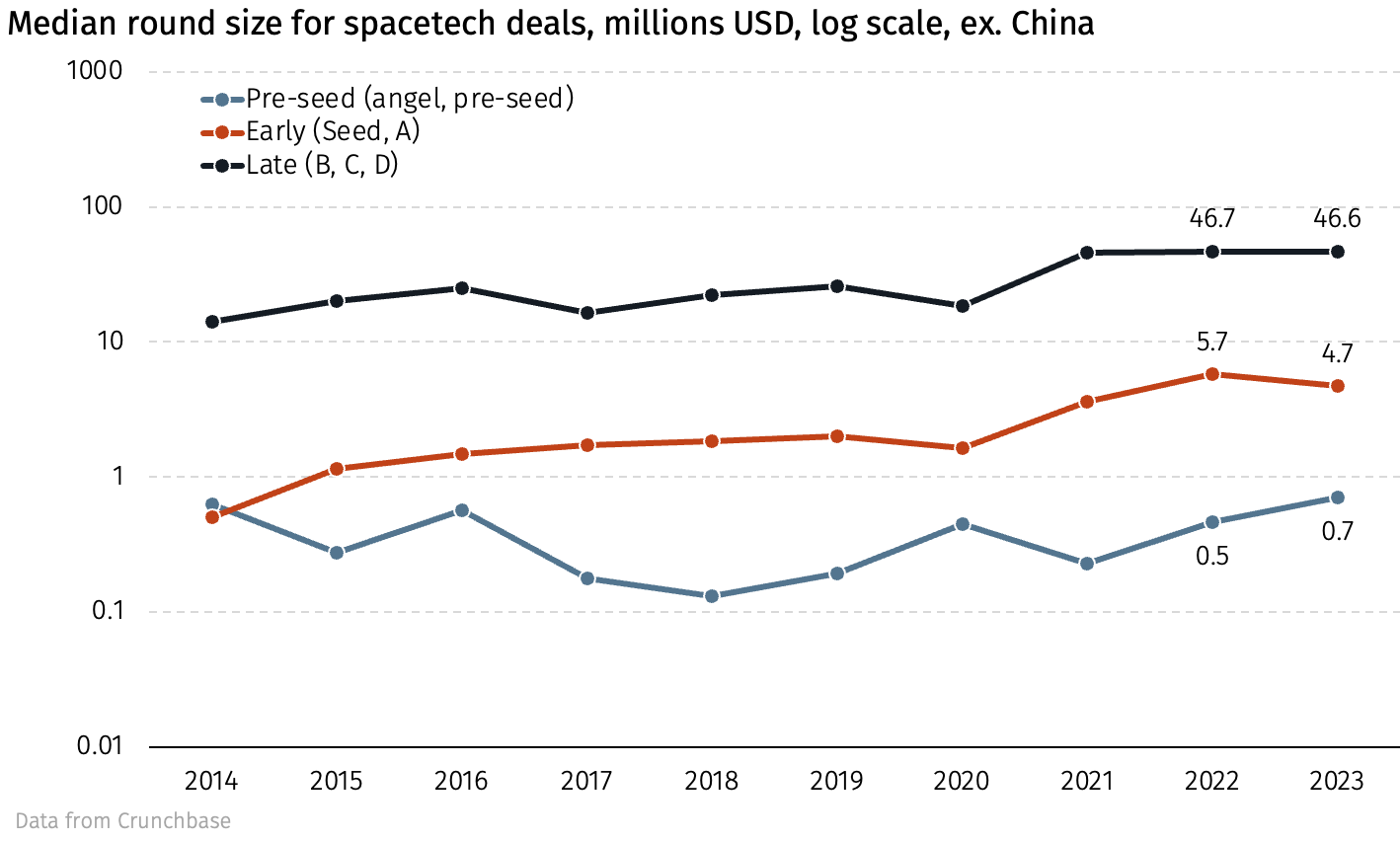

POV: Limited Partner

Starting a discussion about VC, it's important to understand the motivation of limited partners – those who often assume the greatest risk and invest their own capital. Frankly speaking, spacetech investments often add minimal value to a portfolio, as they fail to provide significant diversification or an optimal risk/return profile. Furthermore, spacetech companies typically require more initial funding, take longer to yield returns, which negatively affects the IRR. The median deal size highlights the level of risk, compared to the global VC. However, there must be something why the number of space VCs grows!

We can’t get in every LPs head and understand their motivation, so everything we are left with is making assumptions. It seems the primary attraction for LPs towards spacetech is a long-term vision. This visionary opportunity is a fundamental motivator.

Pause for a moment to understand what is the vision in question. Imagine you were given an opportunity to travel back to 1998 and invest $50,000 in Sergey Brin and Larry Page's novel "search engine." I bet you wouldn’t have thought a second before putting your signature on a check. So here’s a thing: numerous LPs, angel investors, and venture capitalists view spacetech as the next revolutionary tech, so they seek to play a part in its development. This is what I mean by vision is what I mean.

Nonetheless, to stay in the business as a venture capitalist, it's absolutely important to generate substantial returns for your LPs. This is where the expertise of GP becomes crucial – they often offer extensive experience, wide network, and strategic guidance that can be quite important for startups. It's their expertise in identifying promising ventures.

Spacetech Investors in Numbers

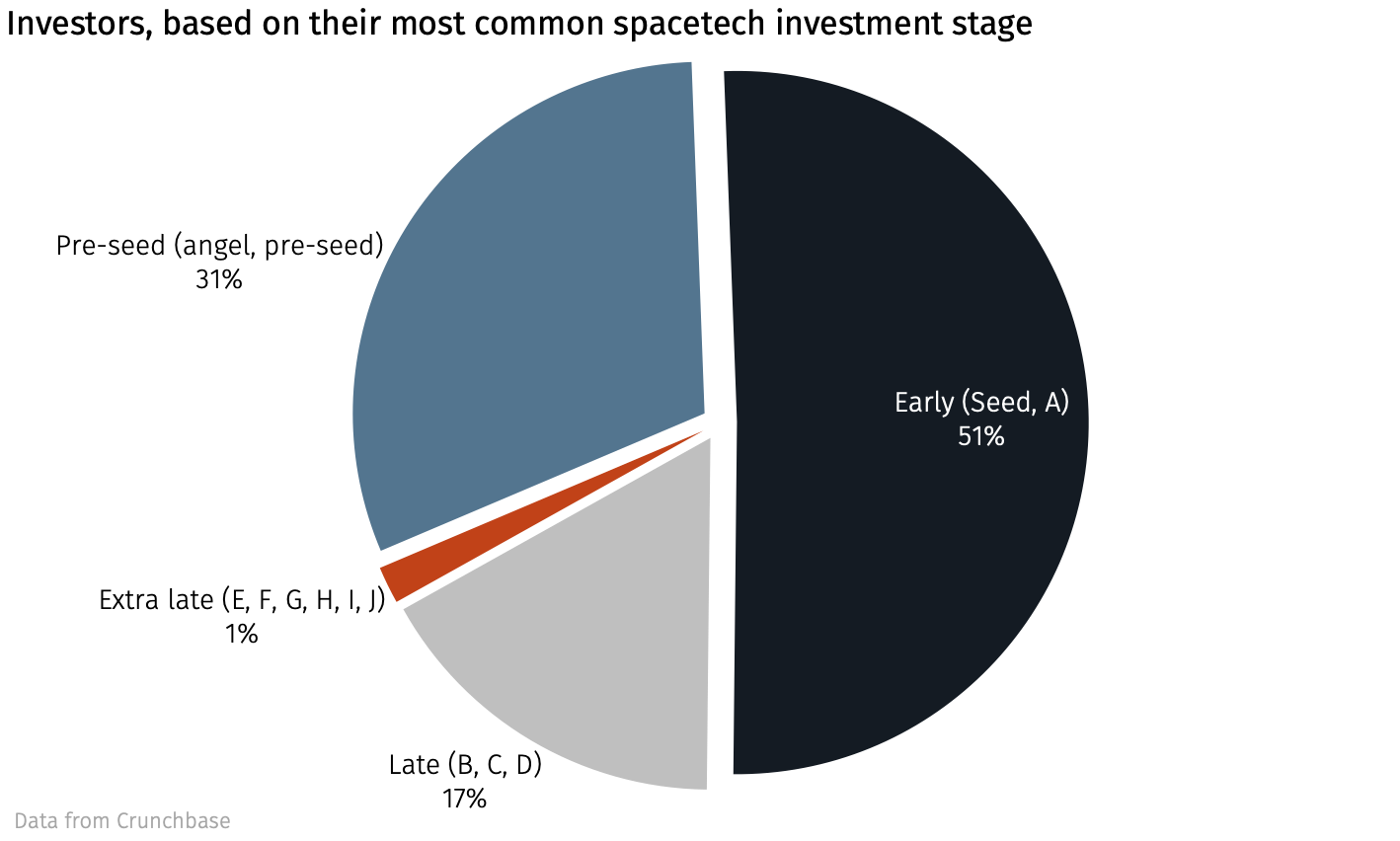

From a variety of VC funds nearly 1700 have made any kind of space-related investments in the last decade. In terms of deal concentration, nearly 10% of the funds participated in more than 40% of all deals for the last 10 years.

In terms of stage distribution, early stages were far less concentrated with top 10% of the funds participating in nearly half of all deals for the last 10 years, compared to nearly 70% for booth pre-seed and later stage.

Regionally, the majority – nearly 67% – of investors are either based in the US or have a significant presence there, which aligns with the fact that the US accounts for nearly 40% of the global space economy. The majority of the deals investors are making are also US-based.

An analysis of the distribution by investment stages reveals the ecosystem suffers from the lack of the later stage investors. Additionally, generalists are more dominant in later stages, and accounting for the largest part of the dollars invested.

In 2023 the picture was a bit different. As allocations hit the lowest since 2014, the most active investors were government entities and specialist VCs. The year finished with a minimum number of newly raised funds.

This analysis has allowed us to draw portraits of both specialist and generalist funds active in spacetech. A typical specialist fund is a relatively small, predominantly early-stage fund, with under $100M of AUM. A fund like this holds a portfolio of 20-30 spacetech companies and usually ticket from $200K to $1M as well as occasionally opt for follow-on investments. Although most probably based in the United States, up to 50% of their portfolio companies are international. Conversely, generalist funds are much larger, and spacetech represents only a minor fraction of their overall deal flow. These are also predominantly early-stage, US-based funds.

The Most Active Specialists

Seraphim Capital

Investments in total: 127 tickets written

Portfolio companies: 93 companies

Exits: 4

Totally allocated: nearly $300 M

Seraphim Capital, a UK-based spacetech fund led by Mark Bogget, adopts a vertical-agnostic approach, focusing predominantly on early-stage investments. You can read the interview with Rob Desborough – a partner of Seraphim.

Space Capital

Investments in total: 76 tickets written

Portfolio companies: 47 companies

Exits: 5

Totally allocated: nearly $65 M

Space Capital, a seed VC firm from the US, specializes in space technology stacks, including GPS, Geospatial Intelligence, and Satellite Communications, led by Justus Kilan, Tom Ingersoll, and Chad Anderson. Raised 5 funds in total.

Airbus Ventures

Investments in total: 110+ tickets written

Portfolio companies: 55 companies

Exits: 11

Totally allocated: nearly $250 M

Airbus Ventures is an early-stage VC company with offices in Silicon Valley, Toulouse and Tokyo. The fund invests in startups from aerospace segment.

The Most Active Generalists

Draper Associates

Investments in total: nearly 380 tickets written

Spacetech investments: 27 (3 in 2023, 0 in 2024)

Portfolio companies: 270 companies

Spacetech portfolio companies: 16 companies

Draper Associates is a US-based venture capital firm. The Company invests in fintech, healthcare, and advanced tech sectors. Draper Associates is a stage agnostic fund.

Techstars

Investments in total: nearly 6000 tickets written

Spacetech investments: 67 (12 in 2023, 0 in 2024)

Portfolio companies: 4500+ companies

Spacetech portfolio companies: 43 companies

As a pre-seed investor, Techstars aids early-stage entrepreneurs, maintaining an industry-agnostic approach. Additionally, they’re providing a top-tier acceleration program (we covered it in one of our publications).

Y Combinator

Investments in total: 6000+ tickets written

Spacetech investments: 43 (5 in 2023, 3 in 2024)

Portfolio companies: 4800+ companies

Spacetech portfolio companies: 27 companies

Y Combinator, a renowned American accelerator and VC, focuses on early-stage, industry-agnostic investments.

To access the complete research behind this post, please upgrade to a paid subscription.

Grants and Angels

While grants and angel investments are hard to track, some of them are worth mentioning including EU Executive Agency for SMEs with 88 and NASA with 47 given grants for the last 10 years, as well as Dylan Taylor (CEO of Voyager Space) and Jackson Moses (Managing Partner at Silent Ventures) with 45 and 19 spacetech angel investments for the last 10 years respectively.

Aftermath

Venture investments in spacetech are on a decline, following the trends across the broader market. Investor activity has dropped, along with a noticeable decrease in the proportion of generalist funds within the total investment landscape.

Despite this downturn, on 14th of February, Y Combinator, issued a call for startups, explicitly mentioning spacetech startups for the first time ever. Furthermore, our analysis reveals that specialist VCs have increased their capital calls for the first time since October 2022.

This means that the challenging environment does not deter VC firms from pursuing opportunities in deeptech and spacetech. Many investors find value in contributing to sectors that promise significant advancements and novelty.

We at Space Ambition think that spacetech, despite its challenges, is not as complicated and challenging from the investment perspective as it might appear. It also represents a significant leap forward for humanity and offers an exceptional opportunity to pioneer groundbreaking initiatives. Email us at hello@spaceambition.org.