Satellite Internet: The Next $100B Market Investors Have Been Waiting For?

The concept of satellite-based communication has been around for over 70 years. What drives visionaries like Musk to continue to pursue this market? Could satellite internet eventually replace fiber?

Issue 57. Subscribers 8429.

Satellite Internet: Brief History

Satellite internet represents an architectural shift in how we access the digital world. Instead of traditional cables and towers, this technology employs communication satellites to provide internet access. While the concept may sound modern, its roots trace back decades.

Telstar 1, the inaugural communications satellite, took to the skies in 1962, initially, for military communications. Telstar 1 was operational for just 7 months before its premature failure, attributed to the Starfish Prime high-altitude nuclear test by the US.

In the 1990s, visionaries recognized the potential of satellites for low-latency communication. This insight gave birth to mega-constellations (for the time they were created, now they're ‘mega-’ anymore) like Iridium, Globalstar, Celestri, and Teledesic. The two later ones were never launched. Eutelsat took a significant step forward in 2003, launching the first satellite dedicated to providing internet access – e-Bird.

Satellite vs fibre internet: 101

46% of the global population still remains unconnected even though it is vital for the economy. To date, only about 1% of the global population accesses the internet via satellite. Although this does not necessarily mean that for all these people satellite is the only way they can access the internet.

Transmission method: Satellite internet communicates using radio waves transmitted between a satellite and in most cases a dish antenna on Earth, and sometimes laser communication between satellites. Fibre internet transmits data using light signals through fiber-optic cables made of thin strands of glass or plastic.

Infrastructure: Satellite internet requires satellite dishes and ground stations to communicate with satellites. Fibre internet needs an extensive network of fiber-optic cables, often laid underground or underwater, and towers for distribution. Once the data reaches local distribution points, it is delivered to individual users via last-mile technologies, which can be cellular, Wi-Fi, or cable networks.

Satellite vs. fiber internet: a comparative analysis

Today, satellite internet falls short in terms of flexibility, pricing advantages, and capacity when compared to fiber internet, primarily due to the state of the technology.

Typically, satellite internet comes with a higher cost, ranging from $50 to $200 per month, in contrast to fiber internet, which has a price range of $39 to $150. This difference can be attributed to high costs associated with launching satellite constellations and higher operational expenditures of satellites.

Also, satellite internet has yet to deliver the highest performance, offering speeds up to 300 Mb/s or less. Additionally, the signal is highly dependent on weather conditions and the user's initial location. In contrast, fiber internet provides a significantly more stable connection, with speeds reaching up to 8000 Mb/s.

With that said, satellite internet is still considered a niche solution. While the market may appear large, it’s not seen as a significant opportunity by many, considering its specifics.

Satellite broadband: market

The global market for satellite broadband is on a significant growth trajectory, with forecasts suggesting a tripling effect. According to industry insights by Euroconsult, the service revenues are projected to reach $12.7 billion, connecting 110 million users by the end of 2029. The global internet service provider industry has a $1.3 trillion market size.

In 2020, the satellite broadband marked a milestone of connecting 43 million users, amounting to roughly 1% of the globe's connected populace. Fast forward to 2029, and this number is anticipated to grow to 110 million.

Diving Deeper: A Regional Snapshot

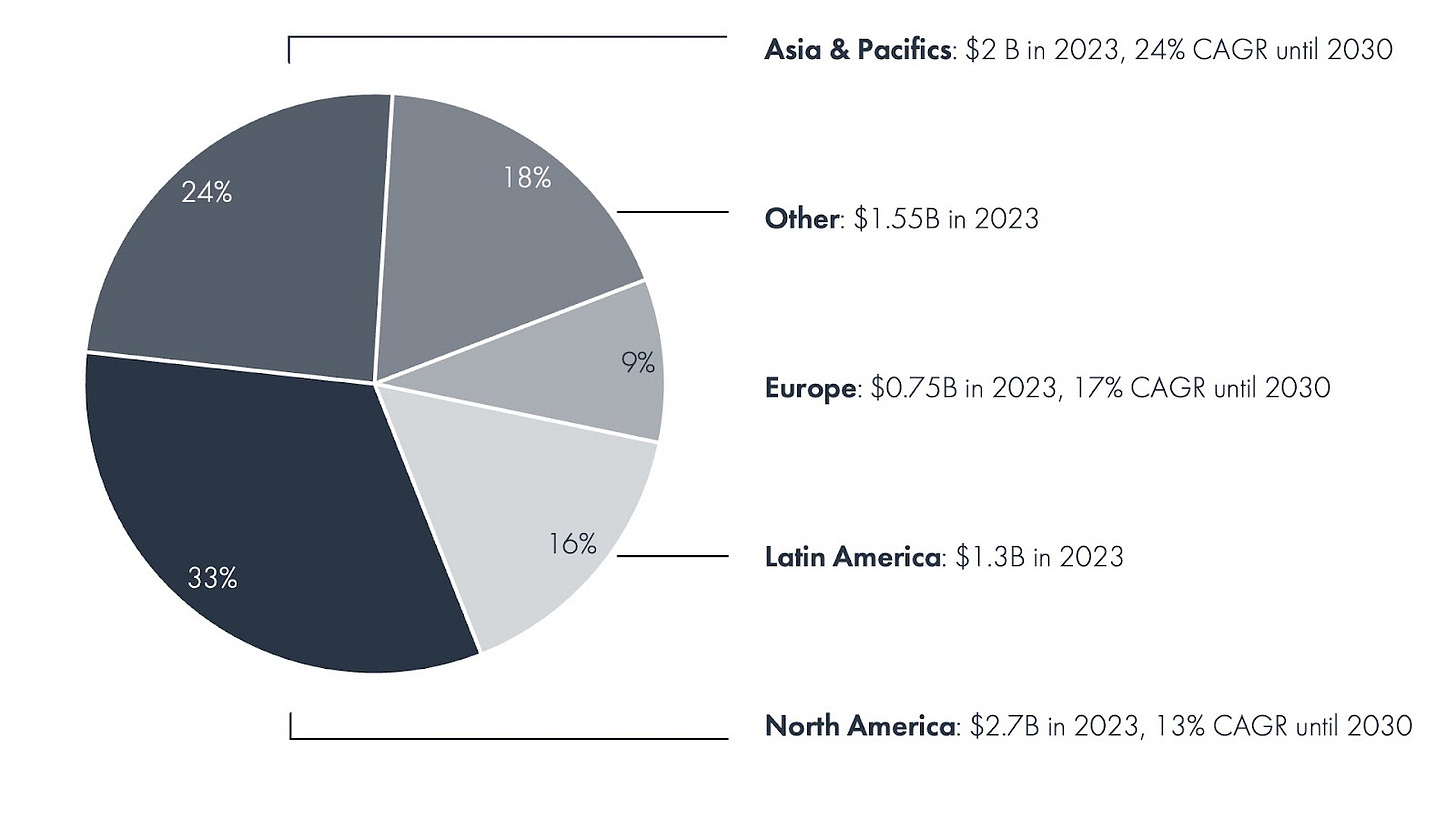

Currently, the largest share of this market is concentrated in the North American region, and estimated at $ 2.7B. Several factors contribute to this dominance, including the US having the world's most significant space technology market.

However the American region has the lowest forecasted growth rate of 13%, while the Asian region leads with its 24%. Some studies suggest that technological development, population size, and geographical expansion may influence the market growth. Moreover, the satellite internet market is sensitive to a country's level of freedom and the availability of infrastructure.

Drivers of the satellite internet industry

Bridging the digital divide. The need to reduce the digital divide by offering affordable entry-level satellite services, especially in remote areas where communication networks are in demand.

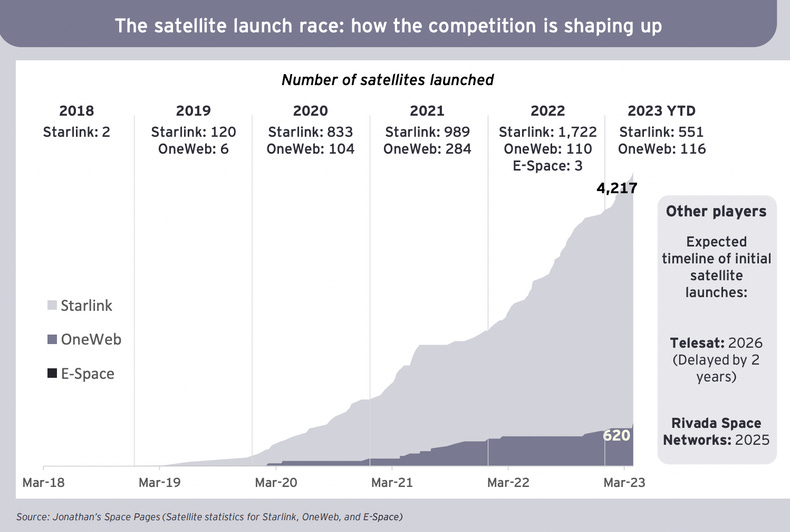

Growth in LEO constellations. More than 5,000 broadband satellites are predicted to be in LEO by the end of 2023, forming two working constellations to provide high-speed internet to nearly a million subscribers globally.

Lowering manufacturing costs of smallsats. The reduced manufacturing cost of smallsats facilitates mass production, driving innovation in the industry.

Satellite IoT and enhanced connectivity. The development of satellite IoT is enabling unprecedented connectivity across industries, further empowering 5G and other capabilities.

Startups involvement. Startups are involved in deploying satellites in LEO, as well as developing other enabling technologies.

Risks of the satellite internet industry

Security vulnerabilities. Satellite internet constellations can be vulnerable to cyber-attacks. For instance, a cyberattack in 2022 against Viasat’s KA-SAT network disrupted broadband satellite internet access across Europe.

Launch and maintenance challenges. The launch and maintenance of a vast number of satellites pose significant challenges. LEO satellites typically have an operational life of 5-7 years, thus regular launches and maintenance is also important.

Mass adoption hurdles. A critical issue for mass adoption is the production of cheaper ground station antennas. Achieving a significant reduction in the production costs of these is crucial for the economic viability.

Latency and data restrictions. Latency and regulatory data restrictions are among the biggest disadvantages of satellite internet, while the latter might be hard to tackle.

Interference and connection issues. The orbit alignment and signal interference, especially in adverse weather conditions, could lead to unstable connections, affecting the quality of service.

Exploring business models in satellite internet

The satellite internet landscape presents a diverse set of business models, each offering unique value propositions and approaches to market penetration. This is not an exhaustive set of business models though and many options may emerge as the industry is developing.

Some satellite internet providers, like Viasat and HughesNet, exclusively focus on providing direct connectivity services to end-users and employ the simplest approach. At the same time, other firms implement more complicated models.

Amazon's Kuiper System integrates its basic connectivity offerings with supplementary value-adding services. While for AKS it is only cloud computing services, for others it can also be entertainment and analytics. This approach helps diversify revenue streams and find synergies between products.

Also, satellite internet providers occasionally choose to collaborate with other firms, building strategic partnerships, to expand their offerings and leverage the partner's resources or customer base. SpaceX's Starlink, for instance, has struck alliances with tech giants like Google and Microsoft, aiming to add to its satellite services cloud computing capabilities

Finally, some satellite internet initiatives lean towards a hardware-centric model, delivering physical tools and equipment to facilitate high-speed connectivity. Starlink Kit (Starlink) is a great example. Customers receive not just a service but a suite of hardware — including an external satellite interface, a ground-based mount, and a Wi-Fi base unit.

Competitive & investment landscape in satellite communications

The investments in the space connectivity sector are huge, totaling approximately $ 9.9B, which slightly exceeds the EO market, with nearly 66 companies with approximately 20 exits since 2015. At the same time, satellite internet represents a relatively small portion of this sector, especially excluding the giants like SpaceX and OneWeb. The segment cannot be described as overcrowded, with only 10-15 firms and most of the investments fall on major players, indicating a significant level of market concentration. A rough estimate of the Herfindahl-Hirschman Index for this segment might fall within the range of 1800 to 3000.

In the table, we assessed some major players in the segment:

Short summary

Today the satellite internet industry with its expansive growth trajectory offers a ground for investments and innovations. The confluence of technological advancements, lowering manufacturing costs, market demand, and technological base might outweigh the manageable risks associated with cybersecurity and operational and regulation challenges, giving a promising outlook for investors and startups.

While we cannot see satellite internet as a direct replacement for fiber internet now, and investments have yet to match those of EO technologies, existing industry players are already demonstrating the reliability of the technology stack, and satellite internet is already accessible to many users worldwide.

With that being said, who knows, maybe the satellite internet is the next $100 B market in the space segment?

At Space Ambition, we firmly believe in a concept of leveraging space technology to benefit existing sectors on Earth. This approach not only unlocks big markets but also attracts significant investments. Satellite internet illustrates this strategy perfectly. Should you have any groundbreaking ideas, please reach out to us at hello@spaceambition.org. We're eager to engage in a creative exchange.