Top Earth Observation Constellation Companies

Explore the history, business scale, revenue dynamics, funding, IPOs, and M&A activities of the leading earth observation companies.

At Space Ambition, we regularly host online SpaceTech pitch sessions. If you’re an investor actively investing or considering investments in SpaceTech, and would like to participate in the next session, please fill out this form. If you're a startup looking to get on our radar, apply here.

One of the key objectives at Space Ambition is to engage and motivate more generalist and DeepTech investors to explore opportunities within the SpaceTech sector. We are confident that many of you will consider Earth Observation startups. When investors make decisions, it's crucial to have examples of IPOs and M&A activities in the sector. That’s why today, we’re providing examples of private constellation operators, alongside public companies, top M&A deals, and the most funded startups that are listed as the top 20 players in industry reports. Each of these operators runs active constellations. We won’t be covering conglomerates like Airbus, Boeing, Lockheed Martin, Thales Group, or BAE Systems. You can find an extended earth observation startup database here. Additionally, here's a list of data providers with over 2,000 satellites.

In this article, we won’t dive deeply into sector trends or market dynamics, but we’ll provide a few useful links for those who wish to explore further. For instance, various sources estimate different market sizes for Earth Observation: Euroconsult valued the market at $4.6B in 2022, forecasting growth to $7.6B by 2032. Straits research estimated $8.8B in 2023, with growth to $16.1B by 2032. Allied Market Research valued the market at $3.5B in 2022, expecting it to reach $6.4B by 2032. Fact,MR projects the market to hit $6.8B in 2024 and $14.6B in 2034. Researchandmarkets forecasts growth from $8.1B in 2022 to $15.9B by 2032.

One of the most significant trends in this niche is the intense competition between the US and China. Other key trends include increased competition and consolidation among commercial providers, advancements in data quality and computing, growth in analytics, AI, and value-added services, as well as expanded use cases across government, military, and environmental sectors. Additional trends include hyperspectral and Synthetic Aperture Radar (SAR) imaging, the rise of “as-a-service” business models, and the emergence of commercial weather satellites. While we will cover more of these trends in future articles, you can explore current trends here (1, 2, 3, 4).

If you’re interested in understanding the challenges of the sector, check out this article. Also, see our articles on earth observation applications in greenhouse gas monitoring (part 1, part 2), agriculture, fighting crimes, and other use cases. Additionally, take a look at our in-depth analysis of Series A deals in 2023.

Public Earth Observation Companies

We identified 83 aerospace companies that have gone public across various sectors. In this article, we focus on 4 public companies with their own Earth observation satellite constellations, which are listed in industry reports among the top 20 players. All of these companies went public via SPAC in 2021 or early 2022. We believe their IPO valuations were significantly overinflated, having since dropped by 5-10 times. Currently, their market capitalizations are lower than the total investments they have raised, meaning these companies need substantial growth to provide strong returns for investors. On a positive note, all of these companies have experienced 2-3x revenue growth since their IPOs. According to reports, the U.S. government and defense sector dominate the revenues of Planet Labs and BlackSky, and we expect this trend to continue. For more information, read the in-depth analysis of the companies' histories and financials below.

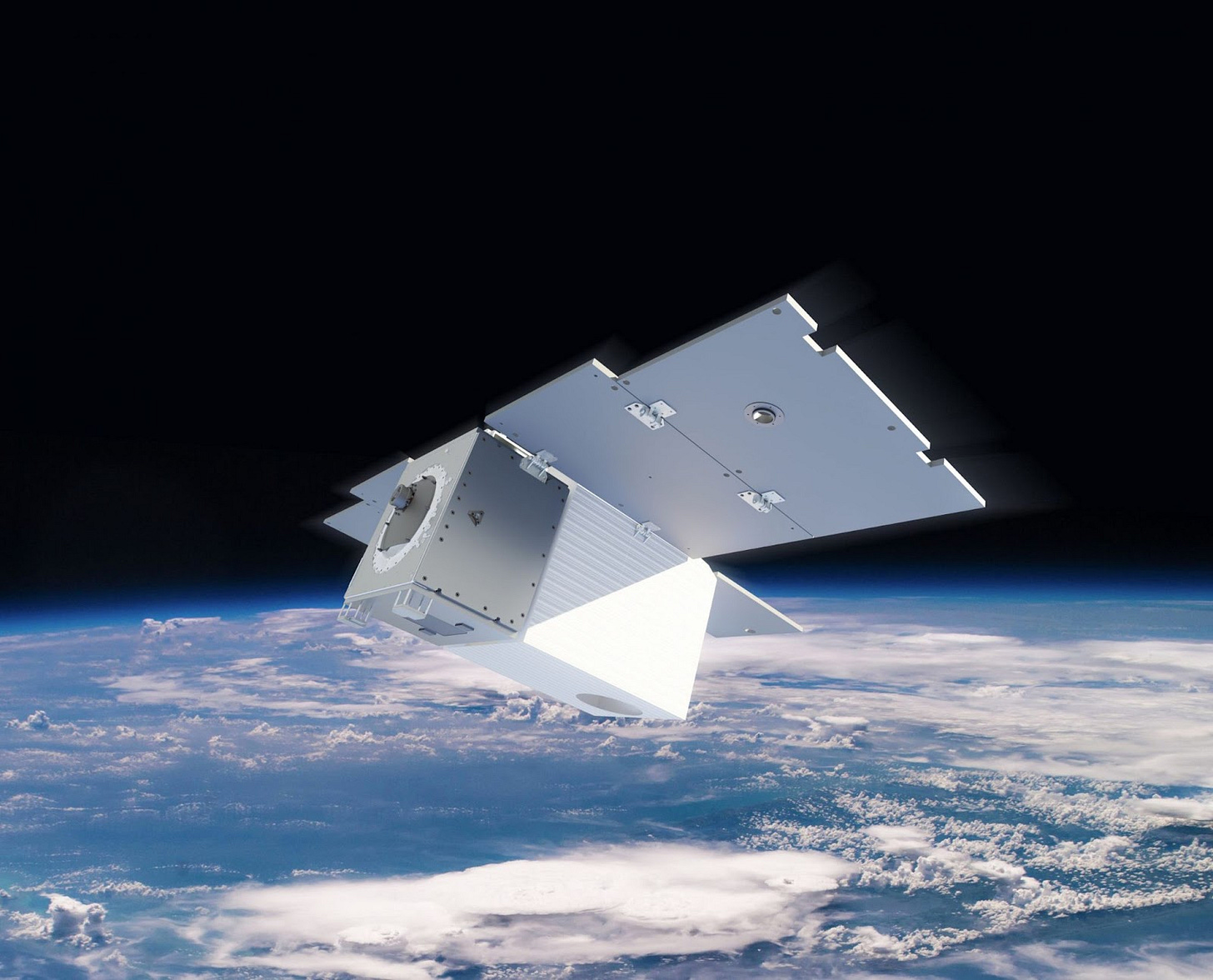

Planet Labs is a U.S. startup founded in December 2010 by former NASA employees Will Marshall, Chris Boshuizen, and Robbie Schingler. The company operates a constellation of over 200 3U-CubeSat miniature satellites, called Doves, which capture daily images of the entire Earth in the visible spectrum. They launched their test satellites in April 2013 and raised $13.1M in Series A funding in June 2013. In total, the company has raised $574M in funding and went public via SPAC in December 2021 with a $2.8B valuation. Its current market cap is $675M, and its trailing twelve-month (TTM) revenue is $236M (up from $131 million at the time of its IPO). According to the latest report, 50% of Planet Labs’ revenue comes from North America, 28% from EMEA, 17% from the Asia-Pacific region, and 5% from Latin America. Defense and intelligence make up 49% of its revenue, civil government accounts for 28%, and only 23% comes from the private sector. The company also acquired the RapidEye constellation in July 2015 and the SkySat constellation in April 2017.

Spire Global is a U.S. startup founded in June 2012 by Peter Platzer, who had a background in finance, along with Joel Spark and Jeroen Cappaert, both of whom had engineering backgrounds. The company operates a constellation of 110 CubeSats to track maritime, aviation, and weather patterns. Spire raised its initial $100k through crowdfunding in July 2012 and followed that with a $1.2M seed round in February 2013. They launched their test satellites in November 2013. The company has raised $672M in total and went public through SPAC in August 2021 with a $1.6B valuation. Its current market cap is $236M, and its TTM revenue is $107M (up from $43M in 2021). You can read their latest investor presentation here.

BlackSky Global is a U.S. company founded in 2013 as a subsidiary of Spaceflight Industries by Jason Andrews and Jim Beckley. BlackSky provides on-demand, high-frequency imagery and analytics, monitoring critical locations, economic assets, and events around the globe. The company operates a constellation of over 60 satellites, with the first satellite launched in September 2016. BlackSky has raised $280M in total and went public through SPAC in September 2021 at a $1.1B valuation. Its current market cap is $183M, with TTM revenue of $106 million (up from $34 million in 2021). According to the latest report, 62% of its revenue comes from the U.S. government, 37% from international governments, and only 1% from the commercial sector.

Satellogic is an Argentinian company founded in 2010 by Emiliano Kargieman, founder of Core Security, along with Gerardo Richarte and Andrew Fursman. Satellogic developed a lightweight, cost-effective satellite system that can be produced at scale. Each satellite carries two payloads—one for high-resolution multispectral imaging and another for hyperspectral imaging. The company offers asset monitoring, constellation-as-a-service, and space system production for sectors such as food, energy, water, climate change, and migration. Satellogic plans to launch 200 CubeSats and currently has over 60 satellites in orbit. They launched their first satellite in April 2013. The company has raised $424M in total and went public via SPAC in January 2022 at an $850M valuation. Its current market cap is $92M, and TTM revenue is $10M (up from $4.2M in 2021). You can read their latest investor presentation here.

Top Earth Observation M&A Deals

For venture capitalists, it is critically important to see the examples of strategic mergers and acquisitions in the sectors they are considering for investment. These deals offer insight into the size of potential future exits. In this section, we will discuss 3 companies from the list of the top 20 Earth observation constellation owners. We have noticed that players in this sector are actively merging with each other and making strategic acquisitions in both Earth observation and related business areas. While the $6.4B deal involving Maxar Technologies stands out, other deals tend to be valued below $1B. We hope to see more significant deals in the future, offering exceptional returns for investors.

Terran Orbital (formerly Tyvak) is a U.S. company founded in 2011 by Jordi Puig-Suari, co-inventor of the CubeSat standard, and Austin Williams. The company provides end-to-end, cost-effective space systems using agile aerospace processes to accelerate on-orbit success. Terran Orbital was officially established in 2013 as a result of the acquisition of Tyvak Nano-Satellite Systems. You can read their full history here. The company has raised a total of $402M and went public via SPAC in March 2022 with a valuation of $1.6B. According to their latest report, the company had $94.2M in revenue in 2022, up from $40.9 million in 2021. Of their revenue, 83% came from the U.S. government, 4% from foreign governments, and 13% from the commercial sector. Lockheed Martin acquired the company on August 15, 2024, for $450M.

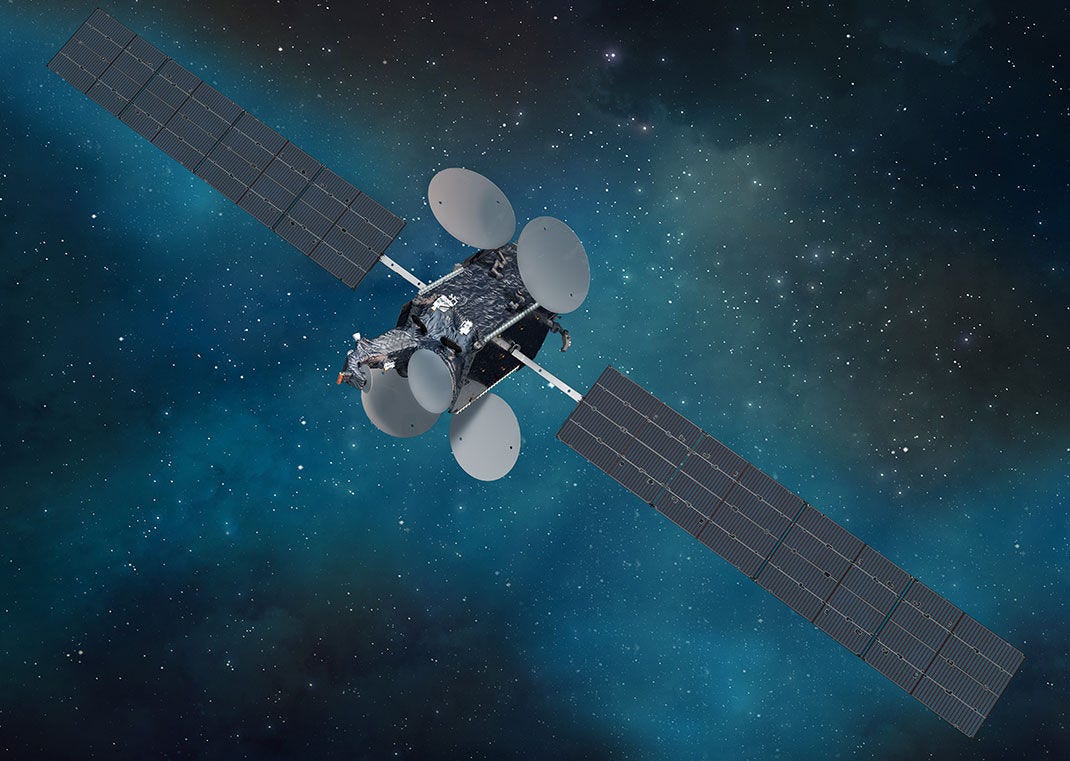

Digital Globe was a U.S. commercial vendor of space imagery and geospatial content, as well as an operator of civilian remote sensing spacecraft. It was founded in 1992 by Walter Scott and Douglas Gerull. In 1993, the company received the first high-resolution commercial remote sensing satellite license under the 1992 Land Remote Sensing Policy Act. In 1995, it merged with Ball Aerospace & Technologies, a manufacturer of spacecraft, components, and instruments for national defense, civil space, and commercial space applications. In 2007, the company acquired GlobeXplorer, an online spatial data company that distributed aerial photos, satellite imagery, and map data. In 2013, it acquired GeoEye. In February 2017, DigitalGlobe was acquired for $2.4B by MDA Ltd., a Canadian space technology company providing geointelligence, robotics, satellite systems, and space operations. After the acquisition, the company rebranded as Maxar Technologies.

Maxar Technologies is a U.S. space technology firm offering communication and observation satellites to governments, military, consumer mapping, energy, environment, mobility, logistics, and telecommunications sectors. The company operates a high-resolution Earth observation satellite constellation. Maxar was formed through the merger of DigitalGlobe and MDA Ltd. on October 5, 2017. In 2018, Maxar acquired the robotics firm Neptec for $32M. In January 2020, it acquired 3D data and analytics firm Vricon, Inc. for approximately $140M. In March 2022, Maxar acquired the AI and software development company Wovenware. On December 16, 2022, Maxar was acquired by Advent International for approximately $6.4B. The company reported $1.6B in annual revenue in 2022.

Venture-Backed Earth Observation Companies

There are numerous private, venture-backed, and state-owned Earth observation constellations. For example, you can find lists of top constellations, the top 12 constellations, and the top 100 geospatial companies. In this article, we focus on 5 Earth observation constellation startups that have each raised over $100M while remaining private. All of these companies were founded between 2011 and 2016. Some provide solutions for both governments and the private sector, while others are solely focused on the private sector. You can explore the extended list of 28 startups here.

ICEYE is a Finnish Synthetic Aperture Radar (SAR) satellite imaging company that provides remote sensing solutions for maritime, disaster management, insurance, and finance sectors. The company was founded in 2014 by Rafal Modrzewski and Pekka Laurila. ICEYE began commercial operations in 2019 and has since launched 38 satellites. The company has a team of over 650 employees and operates in 45 countries. ICEYE has raised a total of $406M from investors including Seraphim Capital and Space Capital.

HawkEye 360 is a U.S. startup founded in 2015 by Chris DeMay, Charles Clancy, and Bob McGwier. The company operates 10 clusters of compact satellites, each consisting of 3 satellites, which orbit the Earth at altitudes between 400 and 600 kilometers and image the Earth using the radio frequency spectrum. HawkEye 360 provides services for defense, maritime, and global protection, addressing issues such as illegal fishing, poaching in national parks, and emergency response. The company has a team of over 180 employees and has raised a total of $412m from investors including BlackRock, Space Capital, Lockheed Martin Ventures, Airbus, Insight Partners, Esri, and SVB Capital.

Capella Space is a U.S. startup founded in 2016 by Stanford alumni Payam Banazadeh and Will Woods. The company operates a constellation of 16 SAR satellites, with the first satellite launched in December 2018. Capella Space offers solutions for defense, maritime, disaster response, and mining. The team consists of over 200 employees, and the company has raised a total of $239M.

GHGSat is a Canadian startup founded in 2011 by Stephane Germain. The company operates a commercial constellation of 12 satellites that monitor methane and carbon dioxide emissions with high-resolution imaging. GHGSat serves clients in the oil and gas, coal mining, waste management, government, regulatory, and climate finance sectors. The company has over 250 employees and has raised a total of $147M.

Unseenlabs is a French startup founded in 2015 by Clément Galic and Jonathan Galic. The company operates a constellation of 15 6U CubeSats that monitor the Earth using radio frequencies. Their first satellite was launched in August 2019. Unseenlabs serves the maritime, civil government, offshore energy, and insurance sectors. The company has a team of over 70 employees and has raised a total of €112.5M.

Although the earth observation sector has not grown as rapidly as many investors anticipated 5 years ago, we believe there are still interesting opportunities to be found in this niche over the coming years. If you would like to discuss ideas and brainstorm investments in this space, feel free to contact us at hello@spaceambition.org.