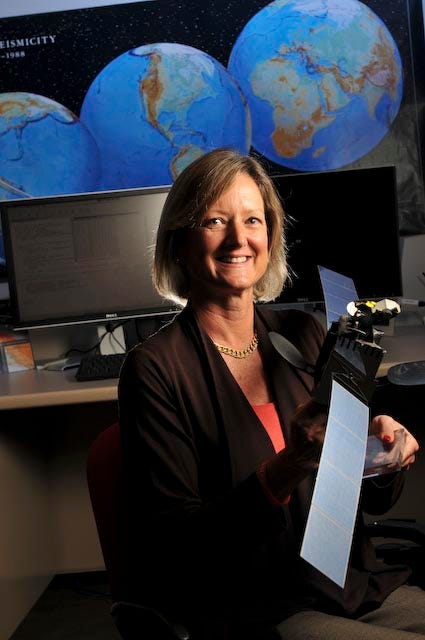

Spotlight: Celeste Ford - Managing Director @ Stellar Ventures

Explore the investment approach and vision for market development from Celeste Ford, an aerospace entrepreneur who brings 30 years of experience to the table and has invested in 27 SpaceTech startups

Issue 101: Astronauts: 13,803.

At Space Ambition, we regularly host online SpaceTech pitch sessions. If you’re an investor actively investing or considering investments in SpaceTech, and would like to participate in the next session, please fill out this form. If you're a startup looking to get on our radar, apply here.

This week, we spoke to Celeste Ford, Managing Director at Stellar Ventures, a U.S.-based SpaceTech venture capital firm focused on pre-seed and seed investments. A seasoned aerospace entrepreneur with 30 years of experience, she shared her insights and vision on market dynamics. Stellar Ventures has backed 27 startups, including Xona Space Systems, Firehawk Aerospace, Darkhive, SatelliteVu, Corvus Robotics, SpiderOak, The Exploration Company, Solestial, and Space Forge. You can read more spotlights on VCs and accelerators here.

Background and Career

Could you share your journey into the space sector? What initially sparked your interest in aerospace and venture capital?

I’ve been in the aerospace industry my entire career, starting as a guidance and control engineer before founding my own business, Stellar Solutions. After transitioning to Board Chair, I began angel investing, which ultimately led me to start a fund focused on supporting the next generation of aerospace entrepreneurs.

As a founder of Stellar Solutions, how did your experience shape your approach to investing in space technologies?

My career and investing approach are deeply customer-centric and mission-focused. I’m driven by solving critical customer needs and investing in areas where we can have a high impact.

Investment Strategy and Vision

What excites you most about the current landscape of space technology? Are there any specific trends or sectors within space that you’re particularly bullish on?

It’s hard to pick just one area, as space is the backbone of diverse sectors—telecom, climate, national security, and even space manufacturing. It’s similar to the internet in the ‘90s; there isn’t a single killer application. The decreasing costs of launches and satellite platforms have enabled missions of every kind. On the ground, there’s also exciting innovation in AI and security for space systems that can be used elsewhere.

What criteria do you prioritize when evaluating space tech startups? What qualities do you look for in founders and their teams?

We evaluate companies based on technical capability, market potential, financials, and the leadership team. We seek founders who thoroughly understand their market and can clearly articulate their value proposition. It’s a plus if they have experience building or exiting a business and have established government connections (as much of the funding in aerospace still comes from NASA, the DoD, and other government agencies).

How do you balance investment between early-stage startups and more established companies? Do you lean towards riskier, innovative technologies or proven, scalable solutions?

We are a seed/pre-seed fund, so we naturally lean toward innovation and early-stage startups.

Role of Accelerators and Partnerships

How important are space-focused accelerators and incubators in shaping the industry? In your view, how do programs like Techstars Space or Starburst influence the growth of emerging companies?

Accelerators like Techstars and Seraphim are incredibly valuable. The space investment ecosystem is still very collaborative, unlike B2B/SAAS where everyone tries to elbow each other out. When any of us find great companies, we work together to help them succeed. This includes government investment funds like IQT and DIU, as well as corporate investors such as Lockheed Martin and Raytheon.

Challenges and Opportunities

What are the biggest challenges that space tech startups face today? How do you see the sector evolving in the next 5-10 years?

While many successful M&A exits have occurred, the negative press around Space SPACs has made some investors wary of the sector. In the next 5-10 years, I expect continued disruption in the telecom industry (e.g., Starlink and others), more diverse missions in low Earth orbit (such as Earth observation and space manufacturing), significant strides toward establishing a presence on the Moon (cis-lunar communications, etc.), as well as ongoing focus on Mars/other space exploration activities and finally supporting Space Force in national security dual use endeavors.

How do you help startups navigate regulatory and operational hurdles in the aerospace industry? What advice would you give to founders on this front?

Many in the industry are well-versed in government contracting and regulatory requirements like frequency spectrum allocation. If a startup lacks this expertise internally, it’s essential to work with or partner with someone who has this knowledge.

What is your take on the increasing involvement of governments in the space sector? How can startups benefit from public funding or government contracts?

Government revenue, particularly from the U.S. government, is crucial for space businesses. The government is investing heavily in new initiatives and upgrading existing systems, and its budgets dwarf those of other funding sources.

Advice and Future Outlook

What advice would you give to entrepreneurs looking to enter the space tech industry today? What common mistakes should they avoid?

Don’t shy away from government funding. Build on the successes of industry leaders like SpaceX and Lockheed Martin. Differentiate your company not just by lowering costs, but by aiming for revolutionary, rather than evolutionary advancements.

What is your long-term vision for space investments? Where do you see the most growth potential, and what’s your approach to staying ahead of the curve in such a rapidly advancing sector?

We see limitless opportunities in the space sector, with exponential growth on the horizon. With the advent of Starship, the amount of infrastructure we can build and deploy in space will increase dramatically. As more people recognize the possibilities, we’ll see even more groundbreaking ideas and innovations emerge.

Thank you, Celeste, for sharing your insights! We also encourage you to explore our articles on topics such as the impact of Starship, the top 50 SpaceTech accelerators, Y Combinator’s SpaceTech portfolio, the investment case of Rocket Lab, Series A deals in 2023, top Earth observation companies, and failures in the sector.

At Space Ambition, we aim to ignite a passion for space exploration. Whether you're a VC, angel investor, accelerator, scientist, or launching a company, reach out to us at hello@spaceambition.org. Let’s explore how we can collaborate. The space sector eagerly awaits your contribution!