Spotlight: Noemie Alliel – Managing Director @ Starburst

Learn how to enter top space accelerators, begin investing in space, select top advisors, spot trends, grasp unique sales methods in the space sector, and discover a startup inspired by our blog.

Issue No 41. Subscribers 6722.

Noemie Alliel is the Managing Director of Starburst Aerospace in Israel and has over 15 years of experience in strategy consulting, operations, entrepreneurship, and business development. In her current role at Starburst Aerospace, she is building bridges between startups and large corporations via Starburst’s accelerator programs, solving industry gaps via the strategic consulting arm, and investing in the next big thing in Aerospace via Starburst Israel Ventures.

Can you tell us about Starburst and what makes it different?

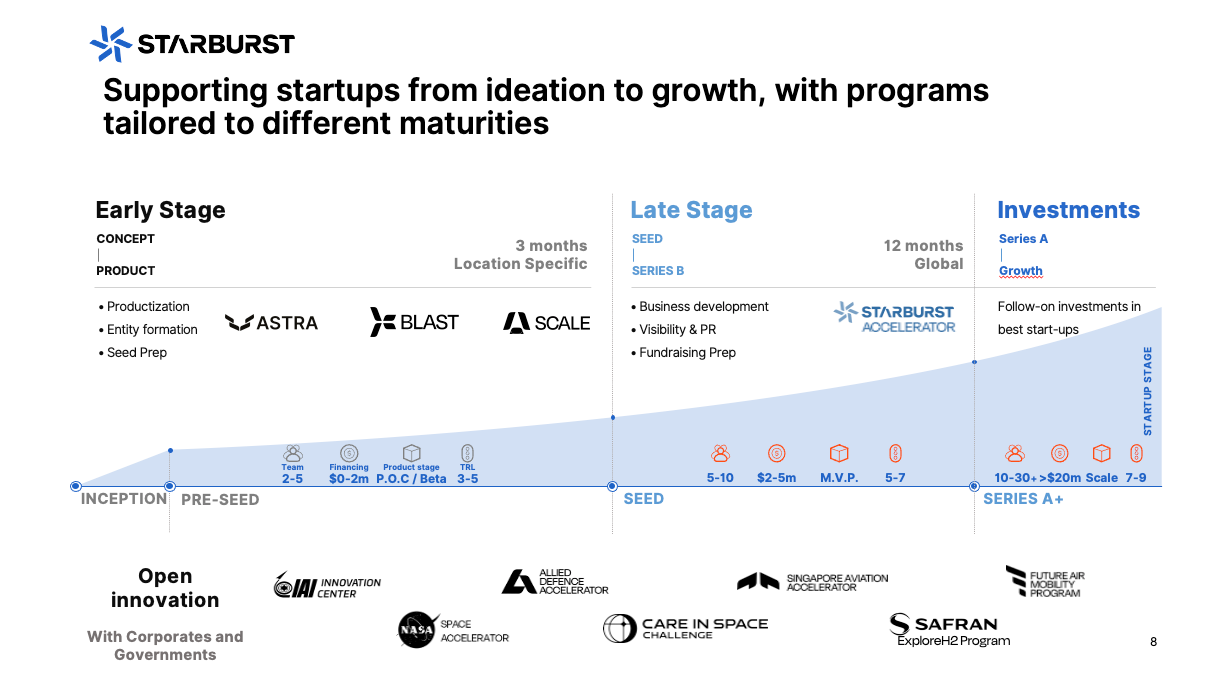

There are two approaches we take to collaborate with startups: our accelerator program, where we offer valuable services in exchange for equity without direct investment, and our active funds that are currently deploying capital. Approximately 140 portfolio companies have come through our doors, with around 110 of them experiencing our accelerator program. Simultaneously, we have ten programs operating in various locations worldwide (e.g., Tel Aviv, Singapore, Madrid, Paris, Los Angeles, and Seoul). Each program brings together industry experts, academia, and major institutions to form a collective that offers immense value to entrepreneurs. On occasion, we collaborate with corporations and other stakeholders to finance these programs. In the case of our Israeli program, ASTRA, we formed a partnership with Israel Aerospace Industries.

The secret to Starburst's success lies in the insights we gain from partnerships with industry stakeholders. We consider ourselves fortunate to have forged partnerships with leading industry players, as they assist us in identifying the most challenging pain points and the specific technologies we should focus on. This collaboration reduces investment risks by connecting us with interested parties, who can leverage the technology.

What do you look for in early-stage and late-stage companies?

We come across a lot of pitches on a regular basis, which necessitates filtering and clear criteria for the key performance indicators (KPIs) that we seek. When it comes to pre-seed stage startups, we prioritize teams of two or three, making it less likely for a solo founder to be accepted into our accelerator due to associated risks. Pre-seed teams often come with just an idea, meaning they may have little else to offer initially. Therefore, the ability to effectively communicate and sell their vision, as well as attract a competent team, is extremely important. While pre-seed teams may not have previous rounds of funding, some may have received angel investments ranging from $0 to 200K. If a team presents only an idea, our objective is to assist them in developing a proof of concept. However, their idea must be thoroughly researched, and they should possess a solid understanding of the competitive landscape.

We evaluate both the team and the idea, considering factors such as uniqueness, innovation, and the value proposition for potential clients. It is crucial that the team understands well who their potential customers or end users are. They should have some understanding of the business model, even if it may change later on. Other factors we consider include whether the team possesses a patent, whether their technology is defensible, and the duration of the co-founders' relationship. We also aim to understand their motivations and drive. Last but not least, the team should be open to receiving advice and demonstrate their willingness to act upon it.

In the case of seed-stage companies, we require them to have completed a seed funding round already. Typically, these companies have 5-10 employees and a valuation below $40M. However, our preferred comfort zone lies between $8-15M. If a company's valuation is too high, we may not secure enough equity to make it worthwhile for Starburst. Apart from this, other aspects are generally negotiable.

For later-stage companies, we look for evidence of traction. While part of our program involves assisting them in acquiring customers, if they already have existing customers or pilot programs with local companies, our role is to amplify their success and provide exposure to the global ecosystem.

Do you consider letters of intent?

While letters of intent can provide some level of support, they hold less significance compared to an actual paid pilot because offering something for free does not validate the business model. Similarly, obtaining a memorandum of understanding (MOU) is relatively simple, but these agreements lack substantial binding power, and therefore, they carry limited weight when making investment decisions. Nothing surpasses the value of a paying client.

Have you changed economic and control rights due to unfavorable conditions in the private market?

No, we have not altered our approach. Our terms have consistently been designed to be both founder-friendly and investor-friendly, as our goal is to support our companies in securing additional funding rounds in the future. The only aspect that may have changed is the valuation, wherein startups might be more inclined to accept smaller investments and valuations. Given the present market conditions, we also advise our portfolio companies to divide their fundraising rounds into multiple stages. For instance, it may be preferable to pursue two rounds of $5M each instead of a single round of $10M.

What qualities should entrepreneurs seek in advisors?

It is important to have advisors whom the team feels comfortable approaching. Companies sometimes make the mistake of bringing in prominent individuals solely for the sake of appearances, based on their impressive titles or positions. However, if the team doesn't genuinely feel at ease contacting them or discussing issues with them, it can be counterproductive. Ideally, advisors should be people with whom the team has a solid relationship. Moreover, they should possess knowledge and understanding of the technology being developed, along with a clear understanding of how they can provide value, be it in terms of product roadmap, technical expertise, or other relevant areas. Therefore, it is crucial for the team to have a diverse group of advisors, including individuals who comprehend regulatory matters, those well-versed in the technology itself, and those with a strong understanding of the business landscape and a wide network. If the team intends to sell to the government, it is also essential to have an advisor with a relevant background in that domain.

What is unique about sales & business development in the space industry?

There are two crucial aspects that deserve highlighting. First of all, patience is essential during the sales cycle, as corporate partners tend to operate at a slower pace and often take considerable time to make decisions. It is no secret that corporations and startups operate on vastly different timelines. Therefore, my role is to bridge the gap and expedite the process.

Secondly, monetization poses a significant challenge. Many struggle to establish a viable business model. For instance, if the goal is to create a machine to feed astronauts, the only clients might be NASA and other space agencies. Additionally, the monetization challenge is exacerbated by the lack of regulatory frameworks, especially in the case of space debris.

There are many investors, who want to get involved and start investing in the industry. What advice can you give them?

Becoming a Limited Partner (LP) is likely the easiest route for investors. Alternatively, investors should begin by immersing themselves in the ecosystem and gaining knowledge about recent trends. This can be achieved through attending relevant events, assuming roles as mentors or advisors, and potentially serving as board members. Cultivating connections is crucial, as it helps a lot with due diligence and deal-flow. Additionally, investors may consider exploring publicly traded funds like ARKX, to further diversify their investment portfolio*.

*No investment advice. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Which trends will define the industry in the next couple of years or decades?

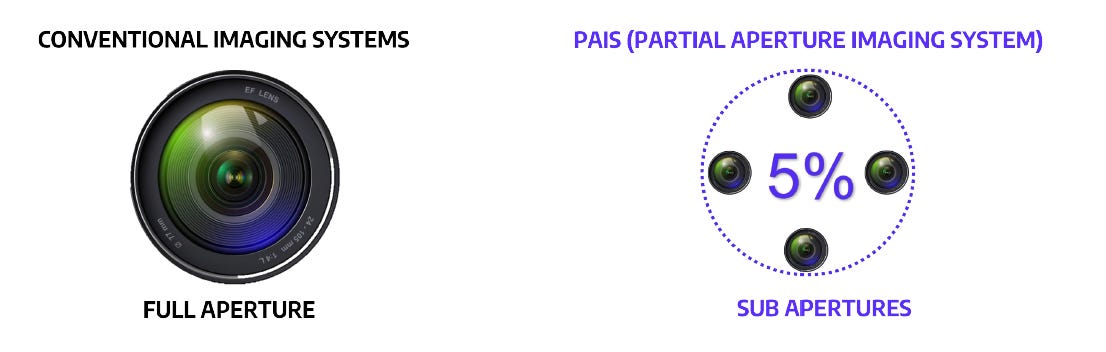

One of the most obvious trends in the space industry is the focus on remote sensing and earth observation. This sector continues to attract significant funding due to its easily understandable business use cases, which in turn reduces risk. Solutions that offer high-resolution imaging along with data analytics for applications such as agriculture, environmental monitoring (our previous articles: Part 1, Part 2), and disaster management (e.g., fire detection and water leaks) are in high demand. The drive for real-time data that enables actionable decision-making on the business side fuels this trend. For instance, Remondo, a company we have invested in, is developing an Earth Observation (EO) solution. Another Israeli company, Noohra, is working on a solution to detect greenhouse gas emissions. Other trends are advanced propulsion systems and innovative materials. These areas of focus are crucial for advancing space exploration.

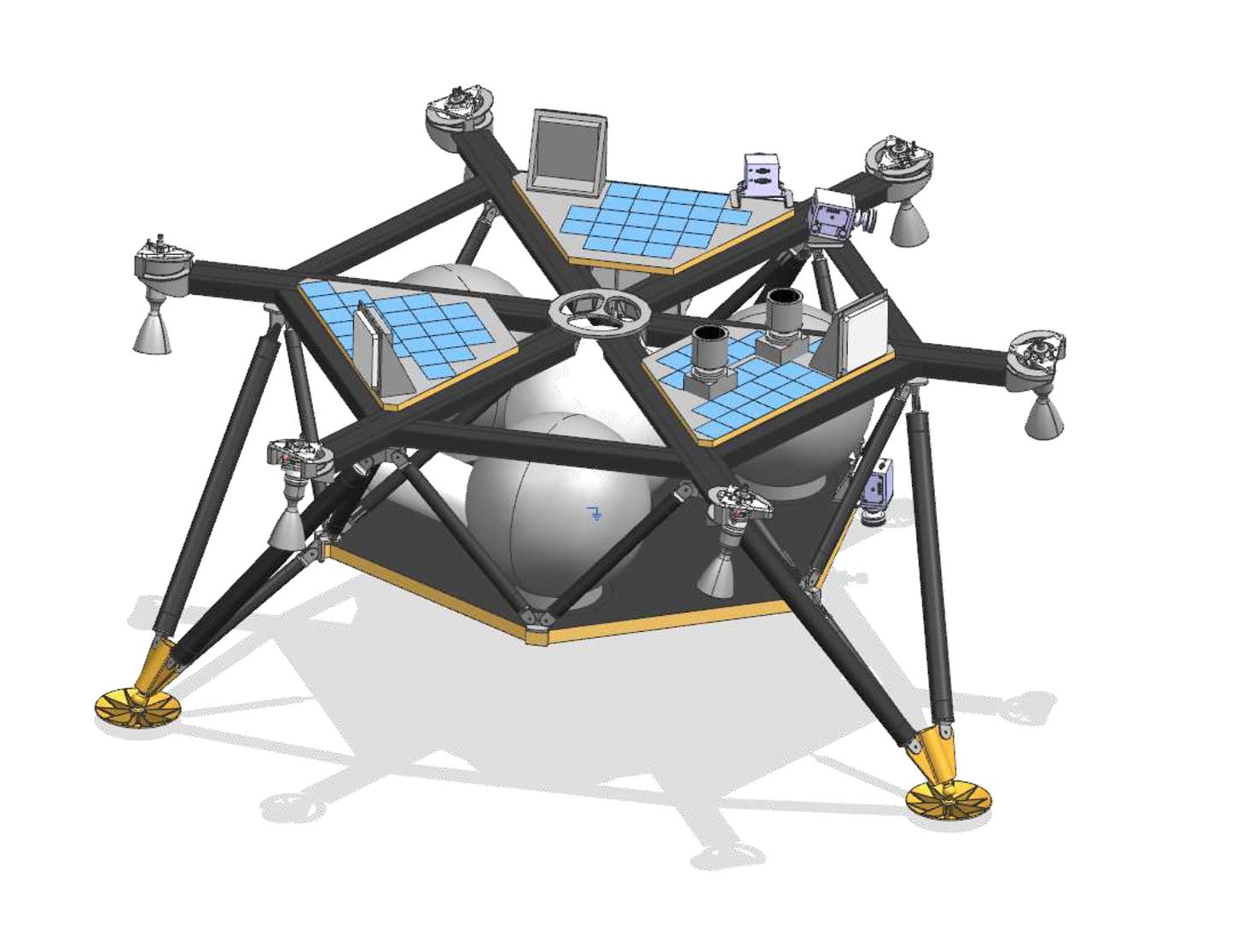

Another trend to consider is in-space manufacturing. NASA, for instance, is dedicated to promoting in-space production, because it is costly to transport payloads to and from space. Potential solutions can involve utilizing materials already present in space through mining. WeSpace, an Israeli company, is actively engaged in this field.

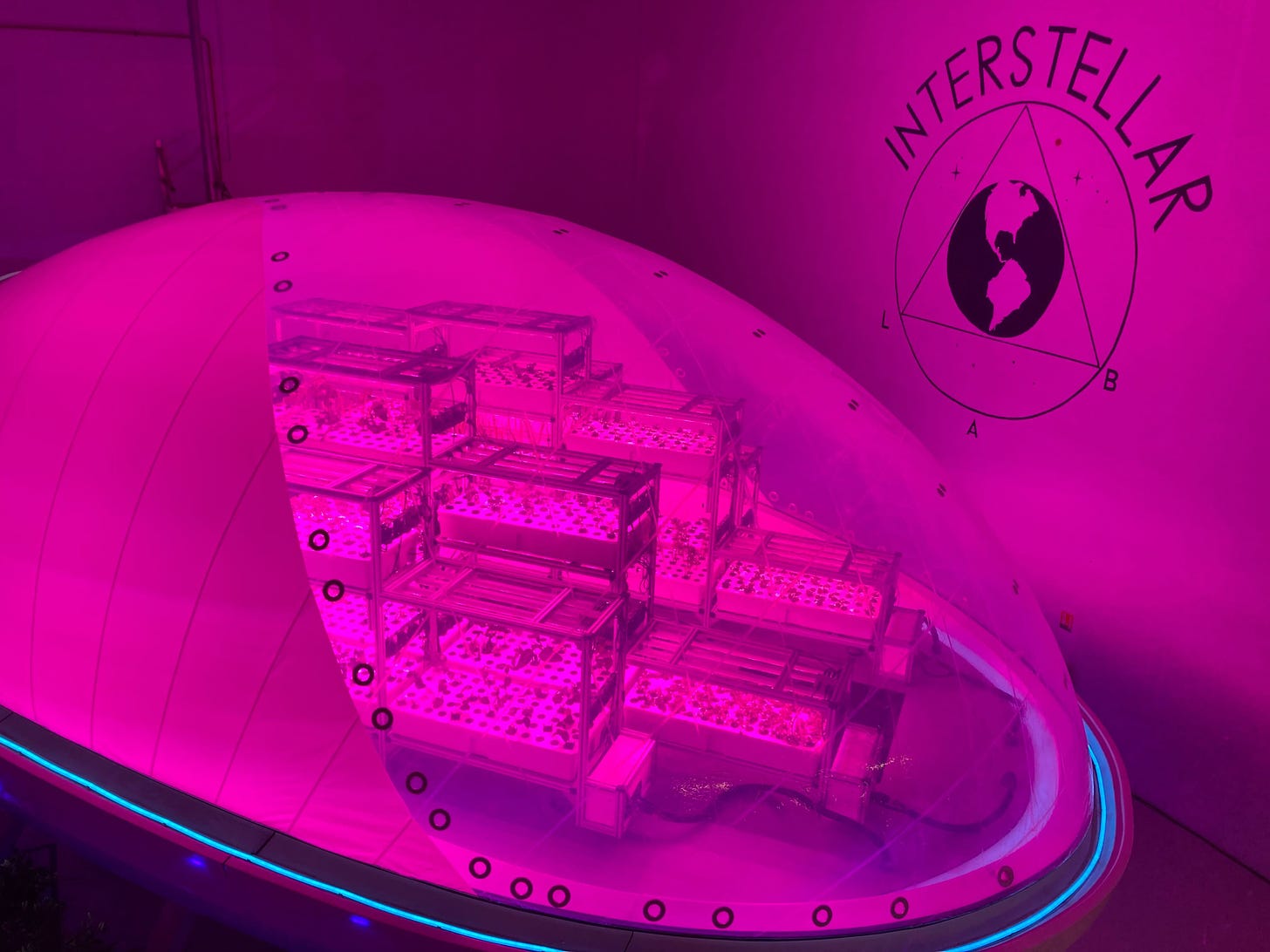

In-space food production is also emerging as a significant area of interest (previous article: link). People are seeking ways to make food, including meat-based products, readily available in space. One of our portfolio companies, Interstellar, recently received an award from NASA for their work on building self-sustained pods that recycle oxygen and water, providing a suitable environment for plant growth.

Thank you Noemi for your insights!

It is extremely hard for founders to navigate in rough waters, when investors are still de-risking their portfolios and global economic uncertainty remains elevated. Nonetheless, it may actually be the perfect time for innovation. We recently found out that one of our readers started a SpaceTech company N.O.A.H and joined Starburst. We're eager to share some insights from their journey:

My legal career spanned most of my professional life, making the shift to SpaceTech rather daunting. However, Space Ambition reassured me that an unconventional entry into this industry was not unheard of. Presently, my venture, N.O.A.H., is a participant in the ASTRA Starburst accelerator. We're leveraging satellite data to revolutionize claims adjustment in agricultural insurance. The program's value is incontestable - the network we've established through it would have taken 3-4 years to create independently.

We trust that this article will ignite your interest to initiate a SpaceTech startup and encourage you to apply to Starburst. As always, should any inquiries or innovative ideas arise, we warmly invite you to reach out to us via hello@spaceambition.org. And remember, the sky isn't the limit, but merely the starting line!

Thanks for inspiring and insightful article. It would be great to read another interview with a SpaceTech VC where she/he elaborates on decision making process and typical startup journey and milestones.