Spotlight: Jonathan Lacoste - General Partner @ Space.VC

We spoke with an emerging manager and serial entrepreneur. Learn how to navigate fundraising during a down market and which sectors can 10x over the next 10 years.

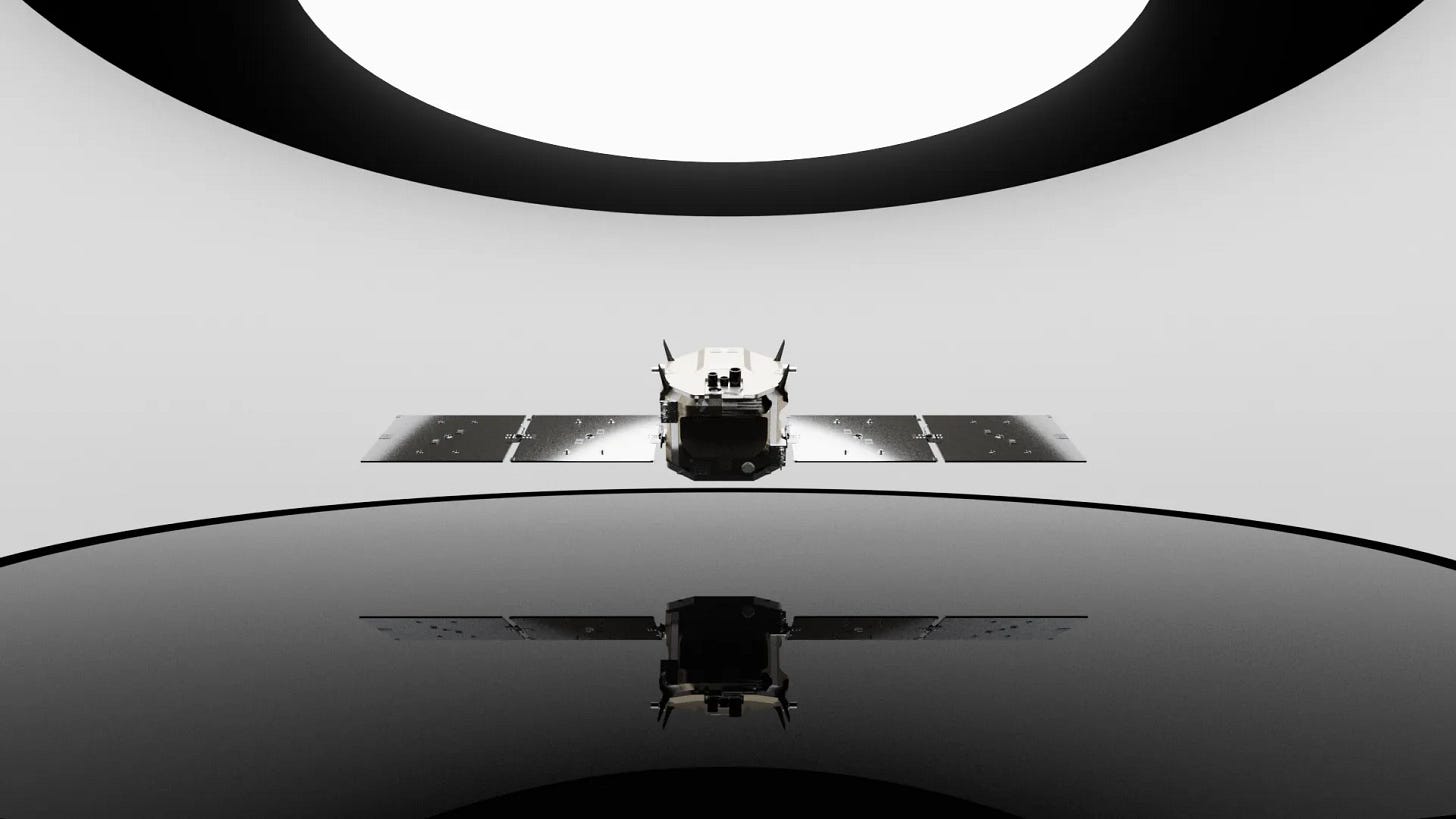

Colony No 70. Astronauts 11,049.

Before you dig in, we have a quick announcement: you can now access behind-the-scenes research that we use for the newsletter! More information here.

Summary

VC name: Space.VC

Website: https://www.spacevc.co/

Average check size: 500K-1M

Stage: pre-seed, seed

Geography: primary US

Sectors: space, defense, manufacturing, AI

Fund size: 20M

Notable portfolio companies: SpaceX, Xona, Pixxel, Space Forge, True Anomaly

What motivated you to transition from software entrepreneurship to space tech? Why do you believe space exploration and investments in space tech are vital?

After a decade of building an enterprise software company, I wanted to spend the next several decades of my career focused on areas of personal interest that also had a wide-scale impact. Space Tech, and frontier tech more broadly, had long been a passion of mine that I had studied and built a network in & felt we could add a lot of value to founders beginning their startup journey. I became convinced that we were moving toward a world of integrated technology where Space was increasingly the silent, resilient backbone of communications, infrastructure, mapping, monitoring, and so many other intelligence & defense applications. It was with this conviction and my prior experience founding & scaling venture-backed companies that I launched Space.VC in 2021.

What is your investment focus?

As a Venture Capitalist, I have a very specific mandate: to invest in technologies that (a) have the potential to be incredibly impactful, (b) have large addressable customer markets, and (c) that can be commercialized within the next 7-10 years. While 10 years may sound long-term, the reality is that especially in Space, many of the technologies or missions that NASA or government agencies are pursuing are multi-decade efforts. Therefore, I do not invest in deep space exploration, asteroid mining, or other exciting space endeavors that I do not believe have large commercial opportunities within that window. Therefore, we focus on space technologies that augment and accelerate industries here on Earth — communications, agriculture, defense, manufacturing, and beyond.

Could you provide practical guidance for those planning a shift towards space tech investments?

At Space.VC, we focused on pre-seed & seed investing, meaning we often back founding teams before they have a product or any revenue. For others looking to invest at a similar stage, I would recommend focusing on (a) the caliber of the founding team, (b) the true size of addressable customers, both governmental and commercial, and (c) the feasibility & capital intensity of the product roadmap and vision. We have deliberately focused on these areas during our diligence and sourcing of space companies and it has served us well. For investors new to the space category & are interested in getting up to speed on investing, here are a few recommendations; I would go to our website & other Space venture capital funds and look at all the companies they've invested in. That will give you a flavor of what VCs are interested in. Then, I'd spend some time listening to great space podcasts, such as Pathfinder by Payload Space, and subscribing to space newsletters, such as Space Ambition, Space News, Payload, and many others. Lastly, if you're looking for in-person conferences, ASCEND in Las Vegas and Space Symposium in Colorado Springs are two of the more prominent ones.

You invest in companies at very early stages, often at 'day zero.' Could you clarify what this entails? What level of traction or technology readiness do you expect?

I prefer to meet entrepreneurs before they have even started their company or right as they are pulling the team together. As a founder, it's better to build a relationship with a VC over time instead of just engaging with us when you're fundraising. For several of our investments, such as True Anomaly, Danti AI, or Array Labs, we were the first VCs to invest and often at the "power-point stage”. This also gives us the ability to be thought partners and help with early employee recruiting, product development, and closing first customer or government contracts. Given we invest so early, we do not expect there to be material product or revenue traction yet, however, we strongly judge teams on their capacity to execute quickly once we invest.

You raised $20M as a first-time General Partner, which is a remarkable achievement, considering the market environment. What’s your unfair advantage?

LPs (investors in VC funds) ultimately need to answer a similar question that VCs ask our founders: why does this company (or VC firm) need to exist? In our case, we believe there is an incredible opportunity for founders building in Space, defense, and adjacent frontier tech industries. This is well-known within the venture already. However, we also discovered that founders building in Space Tech wanted VC firms that had deep founder & operating experience, that had previously built successful companies, that had a strong network in space & government circles, and that ultimately would roll up their sleeves and act more as a partner and extension of their founding team than simply a source of capital. We realized no other firms were checking all of those boxes for founders, which is part of why we've had the success we've had in our initial launch of Space.VC. The other aspect is that while I am a first-time General Partner, I am not new to Venture Capital. As a founder, I have raised nearly $100M in VC funding since 2011, many of the top VCs are investors in our fund or serve as mentors & advisors.

How can investors access high-quality deal flow?

The best founders & founding teams come from all corners; not simply former SpaceX engineers, Space Force employees, or folks who previously worked at a defense prime. We seek to build relationships with founders both within, and outside, the space tech ecosystem that might be interested in starting a Space startup.

If you were to start a space tech company, which sector(s) would you choose?

I always recommend focusing on finding large problems instead of thinking about the technology first. Explore the world, find large markets with existing customers that you think a novel space application could disrupt or enhance, and then explore the best technological solution — perhaps that's in geospatial AI software, GPS/GNSS solutions, edge compute, or a new integrated direct-to-device SatCom constellation.

Which verticals in space tech have the highest potential 10 years from now?

Space Tech intersects with dozens of adjacent industries and we believe those intersection points offer interesting investment opportunities — manufacturing for space & defense, software solutions using geospatial data, integrated communications using both satellite & terrestrial infrastructure, defense & intelligence applications, and beyond. We are also excited about founders using the insights from building in space — building complex hardware & software systems in an agile manner — in adjacent frontier tech & defense ecosystems.

👋 Note from the team

We aim to ignite passion for space exploration. Whether you're a VC, business owner, angel investor, accelerator, or entrepreneur — drop us a line at hello@spaceambition.org. We’d love to chat with you!

Good piece !!!