Deep Tech Spin-Offs: Selecting the One That Could Make You a 50x Return

Scientists are the architects of tomorrow. Where can you find the most promising university spin-offs? What formula for success makes a spin-off a unicorn or one that successfully launches an IPO?

Issue 72. Subscribers 11 064.

Exciting news! Gain exclusive access to our curated list of our favorite investment syndicates, featuring Deep Tech deals we are actively tracking. And many more awesome extracts! More information here.

While our focus typically is on space technology, spacetech falls under the broader category of Deep Tech. Today, we've expanded our scope to a wider array of Deep Tech. At Space Ambition, we strongly believe that Deep Tech represents the most robust sector for venture capital investments today, and we anticipate that the next 1,000 unicorns will emerge from the Deep Tech domain. Today let's look into Deep Tech spin-offs — a breed of startups that originate from academic institutions.

Deep Tech Explained

Deep Tech, short for Deep Technology, refers to a category of technology startups that base their product on scientific advances or high-tech engineering innovations. Deep Tech ventures typically aim to address complex challenges in industries such as biotechnology, pharmaceuticals, robotics, artificial intelligence, aerospace, clean energy, and advanced materials, among others. Deep Tech could be the secret weapon to tackle big global issues like climate change, sustainable energy, and healthcare.

Key Attributes of Deep Tech Ventures:

Intellectual Property(IP): ownership of proprietary technology or processes, underpinned by patents or exclusive rights. Investors appreciate a robust IP because it means resilience; even if the company encounters a major challenge, it doesn't spell the end. This strong IP position is a safeguard, ensuring the company's longevity and stability in the face of obstacles.

Revolutionary Breakthroughs: the capacity to revolutionize industries and impact societies profoundly.

Extended Growth Timeline: Deep tech ventures often require more time to mature and reach market readiness due to the complexity and continued R&D of their technologies. The initial prototype stage might happen only at Series B while in more traditional tech it will be a seed stage.

Increased Capital Needs: the scope of deep tech projects usually demands more investment to support research, development, and scaling efforts.

Higher Market Valuations: Reflecting their potential to create significant impact and generate substantial returns, deep tech companies often command higher valuations in the investment community.

The increasing trend of investing in deep tech shows that there is an understanding of its overall importance. Investing in such projects takes longer to grow compared to other tech investments—about 25% to 40% more time from the initial funding stages, according to BCG Investor’s Guide to Deep Tech. There's also a higher risk of these ventures failing at each stage compared to other tech investments.

You might wonder why one should invest in Deep Tech, given its higher risk and longer time to return. It's a valid question. The common response is that investments in Deep Tech are pursued with the expectation of higher valuations at M&As and IPOs, due to the unique technology offerings and untapped markets. Additionally, investors are often attracted to Deep Tech because it is typically supported by government grants and contracts, which can mitigate investment risks and enhance the prospects for substantial returns. In several regions, including the European Union, a significant number of Limited Partners (LPs) in investment funds are government entities. Based on our experience, these governmental LPs demonstrate a higher propensity to invest in funds specializing in DeepTech. Their motivation is often to address challenges related to technology sovereignty, highlighting a strategic interest in fostering innovation and securing technological independence.

Is the formula that straightforward – combine a scientist, a world-class businessman, and a very patient investor? Let's dive deeper and explore.

Spin-Off Explained

Given that Deep Tech ventures often require substantial IP, it's typical for them to have connections with academic institutions, where much of the research and development takes place. An academic spin-off in the Deep Tech sector is typically founded on intellectual property (IP) developed within academic institutions.

When a scientist, whether a PhD candidate, postdoctoral researcher, or professor, develops a technology with commercial potential, their first step is typically to secure a patent. It typically requires coordination with the university's technology transfer office (TTO), which manages intellectual property on behalf of the institution. The TTO assesses the technology's commercial potential, handles the patenting process, and helps in negotiating licensing agreements with potential commercial partners or the spin-off company.

Following this, they face a pivotal decision: remain in academia, serve as an advisor or board member to the company while retaining minority ownership, or leave their academic post to become a co-founder of a new venture. There's no universally correct choice—it hinges on personal preference and circumstances and the specifics of the project. Some scientists opt to stay within academia, holding stakes in multiple ventures. This approach allows them to leverage their research capabilities while diversifying their impact and potential financial returns across multiple industries or applications.

As previously noted, Deep Tech startups often have a higher level of risk and complexity. Additionally, scientists may not always possess the entrepreneurial skills necessary to navigate the commercial landscape, further compounding these challenges. Scientists must identify the appropriate business co-founders who can lead fundraising, business strategy, and market penetration and complement their technical expertise. We often meet talented entrepreneurs who, despite lacking specific domain expertise in technology, have the potential to excel as CEOs in deep tech ventures. Often, they hesitate to launch a Deep Tech startup venture due to this gap in technical knowledge. However, such apprehension is unnecessary. The solution frequently involves collaborating with a co-founder who possesses robust scientific knowledge and intellectual property. Leveraging the support offered by academic institutions and government entities, such as grants and incubator programs, is equally important. Finding suitable partners and investors who understand the unique demands and potential of Deep Tech ventures is essential for bridging the gap between groundbreaking scientific research and successful market entry.

Leading Countries and Universities in Academic Spin-Off Creation

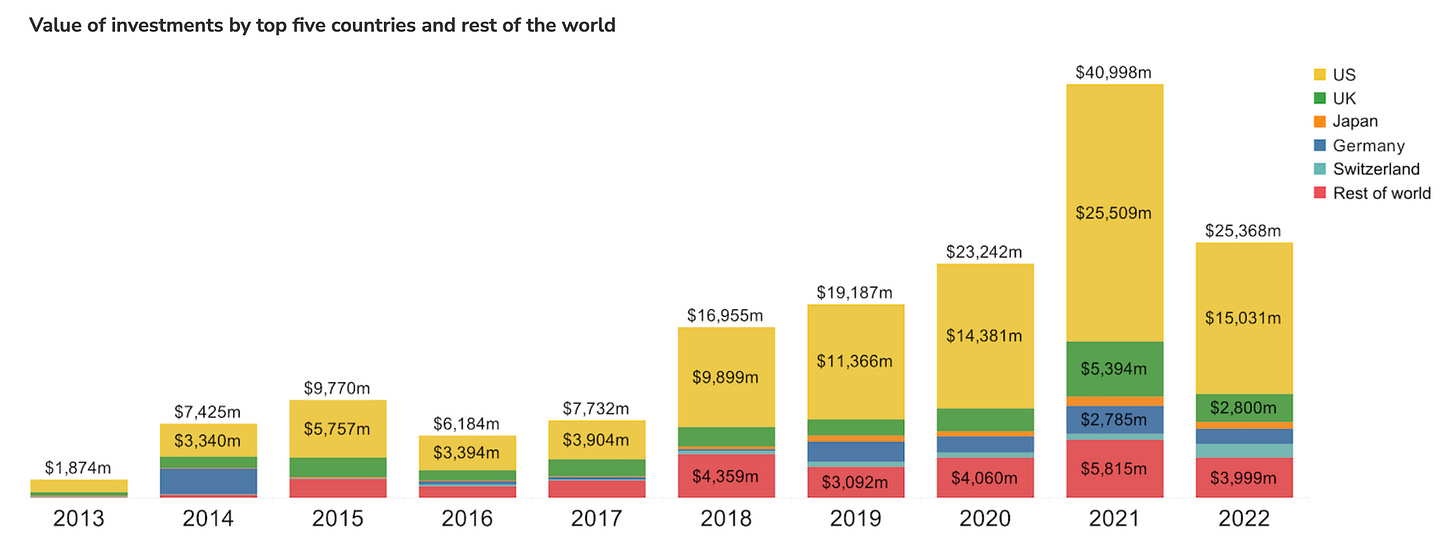

More than $158bn across 8,042 investments — that is the amount of equity financing raised globally by the spinouts reported by Global University Venturing in the decade from 2013 to the end of 2022.

To provide insight into the global landscape of academic spin-offs, consider the following graph. Although it encompasses a broader range of sectors beyond just Deep Tech, the graph offers a comprehensive overview of the overall investment climate in spin-offs. Notably, the United States stands out as a frontrunner, leading in the number of deals, the volume of capital raised, and the frequency of successful exits.

Delving into the specifics at the university level, the University of California systematically stands out, generating over 80 spinouts annually. Similarly, prestigious university systems associated with Harvard, MIT, and the University of Texas each contribute more than 20 spin-outs annually.

However, the output of academic spinouts varies significantly across different universities, with many institutions not approaching these figures, highlighting regional disparities. In 2021, universities in the US and Canada collectively produced 1,121 spinouts, while European institutions contributed 612. Japan, with data from 2019 as the latest available figures, generated just 77 spinouts.

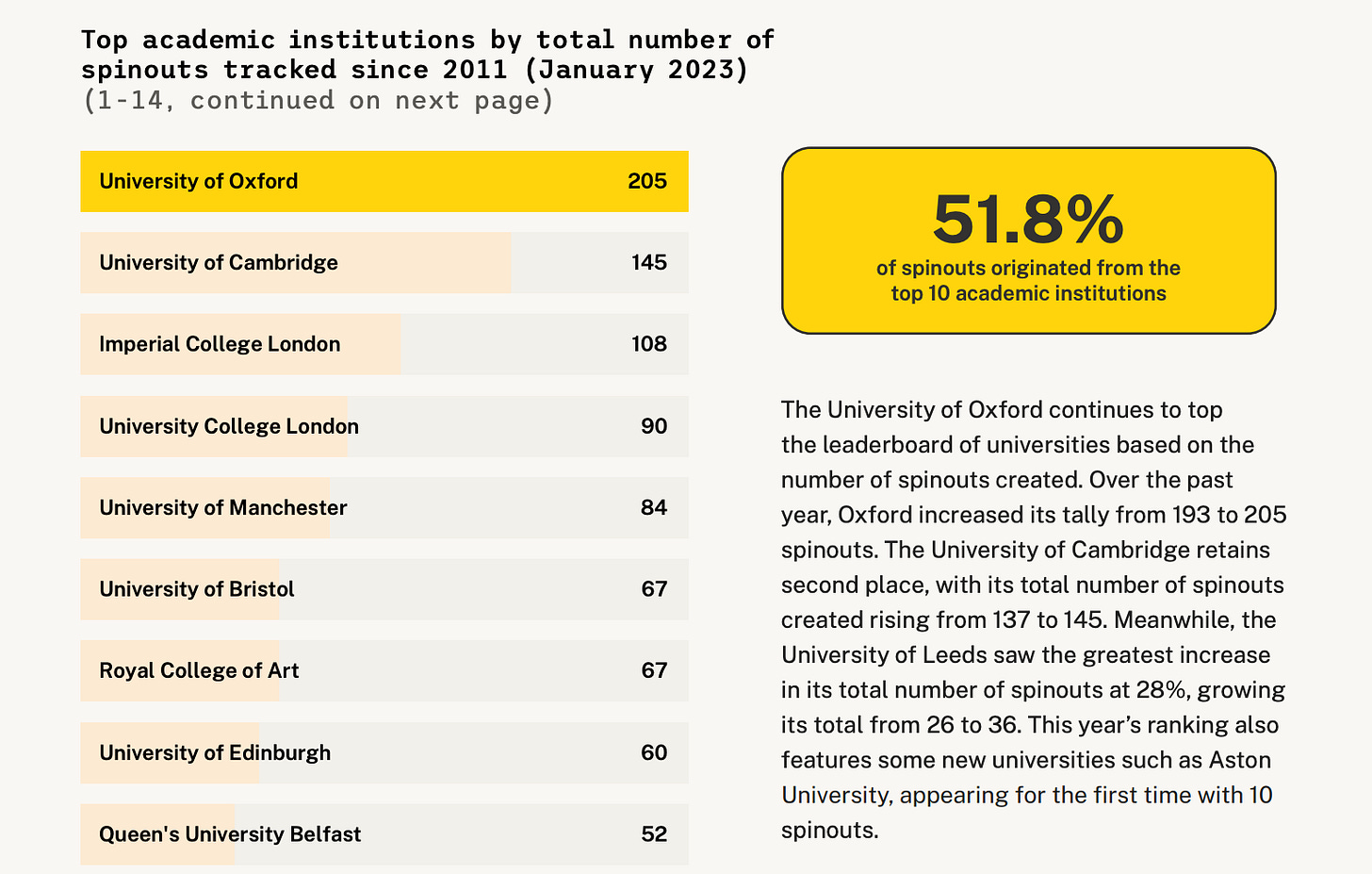

This trend is mirrored in the UK, according to this report on UK spin-offs, where over 50% of spin-offs originated from just 10 universities, indicating a concentration of spinout activity within a select group of higher education institutions.

Let's explore the factors contributing to the success of these countries and universities in generating academic spin-offs.

A Recipe for Success to Create Spin-Offs: University of Oxford Case Study

Oxford University, highlighted earlier as a leading institution in the UK for generating numerous university spin-offs (more than 200 in the past decade), presents an intriguing case study. Upon closer examination, it becomes evident that Oxford University, alongside the Saïd Business School, has cultivated a comprehensive ecosystem that provides extensive support for spin-offs.

In 2018, they set up a business accelerator called the Oxford Foundry Elevate Accelerator. It supports businesses in their early stages by providing skills training, mentoring, and access to investment. There is also the Oxford Venture Builder and even a program for Entrepreneurship for Physicists. The BioEscalator, Oxford University's Biotech incubator, provides lab space and entrepreneurial support for high-growth startups. And then there is TheHill, an innovation catalyst for healthtech, embedded within Oxford University Hospitals NHS Foundation Trust.

Oxford Science Enterprises VC was established in 2015 (£600M+ raised) with the mission to invest in spinouts from Oxford University, specifically targeting the deep tech, health tech, life sciences, and AI sectors. To date, Oxford Science Enterprises has participated in 105 equity deals involving spinouts, with a combined valuation of £1.45 billion, attracting 200 co-investors in the process. They have written cheques as small as £50,000 and as big as £25m+. There is also the Oxford Seed Fund which invests in the top Oxford-affiliated startups. Venture capital firms that support scientific ventures, such as IP Group, also show a strong preference for backing projects associated with Oxford. Industry collaborations like Lab282, a partnership between Oxford University and Evotec, are another interesting example, which provides funding ranging from £50,000 to £500,000 to advance biomedical research.

Furthermore, in 2021, Oxford University revised its founder equity policy to allocate 80% to the founding academics and 20% to the University (pre-money, fully dilutable), significantly enhancing its appeal to investors. It is widely recognized that investors are hesitant to fund companies where the university retains as much as 50% of equity—a figure that represents the industry's upper limit—at the time of incorporation. Founders who find themselves as minority shareholders in the early development stages of a startup are likely to experience a rapid decline in motivation.

This model, characterized by its robust support structure for innovation and entrepreneurship, could serve as a blueprint for other universities to emulate.

How to Launch Your Deep Tech Venture

Are you wondering what to do if you're not an Oxford alumnus? Rest assured, not all is lost. Numerous opportunities worldwide allow both scientists and entrepreneurs to embark on launching a Deep Tech venture. Here are some of our top picks:

Y Combinator, the famous Silicon Valley accelerator, has funded over 75 university spin-offs. Explore their guide on transforming your scientific research into a startup.

Activate is a fellowship program designed to empower scientists to become founders. It has a track record of supporting 146 startups, which have collectively attracted $1.4 billion in funding.

Techstars Berlin, an accelerator focusing on Deep Tech and spin-offs, covers a wide range of areas including AI & ML, Space, Life Sciences, Robotics, Climate Tech, the Future of Computing, and the Future of Mobility. Check out an interview with their Managing Director.

Outset is the home of Deep Tech in New Zealand. They help to grow science and engineering start-ups from idea to global impact.

Wilbe assists scientists in transitioning into founders by offering education, aiding in the search for a business co-founder, providing legal support for spin-off processes, and securing funding.

Entrepreneur First offers a global program designed to assist individuals in launching startups from scratch and finding a co-founder, with a particular emphasis on academics and PhD holders.

The Singapore Deep Tech Alliance assists individuals in discovering intellectual property (IP), identifying co-founders, acquiring clients, and securing investments.

Cicada Innovations stands as Australia's premier incubator for startups and scale-ups focused on science and engineering innovations, specifically within the Deep Tech sector.

Beyond Earth Technology is a venture builder dedicated to Deep Tech innovations that will facilitate life beyond Earth, encompassing sectors like energy, food and agricultural technology, carbon removal, and more.

Plug & Play Tech Center has established partnerships with universities and has invested in over 75 university spin-offs.

The Hello Tomorrow Global Challenge is designed for early-stage Deep Tech startups and their community.

Deep Science Ventures is a venture creation firm dedicated to assisting scientists in building enterprises. Over four years, they have established more than 35 companies, with a focus on agriculture, climate, computation, and pharmaceuticals.

Additionally, numerous university-focused Deep Tech venture support programs exist, including Stanford's StartX, MIT's Delta V, The Engine - Powered by MIT, Berkeley SkyDeck, Columbia Startup Lab, Cornell's FastTrack Startup License program, Venture Kick for Swiss universities, and Imperial College London's Techcelerate.

You can check out the list of the top 50 accelerators in incubators for SpaceTech in our previous article.

Examples of Spin-Offs Founded by Scientists Made it to IPO or Became Unicorns

If you know scientists, please share this article with them. We have curated a diverse selection of companies that originated as academic spin-offs from various countries and across different fields.

Oxford Nanopore Technologies, a pioneering biotechnology firm based in the UK, specializes in the development and commercialization of groundbreaking nanopore sequencing technology. This innovative, electronics-based DNA/RNA sequencing approach is utilized in over 80 countries for diverse biological research applications. Established in Oxford in 2005, completed IPO on the London Stock Exchange in September 2021. The company boasts a market capitalization of £1.34 billion. Hagan Bayley, the founder, serves as the Professor of Chemical Biology at the University of Oxford.

UiPath founded by Romanian entrepreneur Daniel Dines and his team, UiPath is a leader in Robotic Process Automation (RPA) technology. It began as a project at the Bucharest University, where Dines was exploring software for automation. UiPath has significantly impacted how businesses automate their repetitive tasks, growing into a unicorn with a valuation of over $35 billion at its peak after going public in 2021.

Graphcore, a UK-based company specializes in the development of advanced chips for artificial intelligence and machine learning applications. Graphcore was founded by Nigel Toon and Simon Knowles, who spun out the technology from their research activities. The company has achieved unicorn status, with a valuation surpassing $2 billion, backed by investments from leading venture capital firms and technology companies.

Microwave Chemical is a trailblazing chemical company headquartered in Japan and is at the forefront of utilizing microwave technology to revolutionize chemical manufacturing processes. By leveraging microwave energy, the company offers environmentally friendly, energy-efficient solutions for synthesizing chemicals, reducing traditional process times, and enhancing product quality. Founded in Osaka in 2007. Market capitalization is ¥21.90 billion ($147.5 million). Yasunori Tsukahara, co-founder and an expert in microwave, inorganic, and photochemistry, progressed from a doctoral graduate at Osaka University in 2003 to an invited associate professor at the same institution by 2018.

DeepMind Technologies is a spin-off from University College London, DeepMind specializes in artificial intelligence to solve complex problems that plague humanity. Founded in 2010 by Demis Hassabis and his co-founders, DeepMind was acquired by Google in 2014 for around $500 million.

Blue River Technology is a spin-off from Stanford University, founded by Jorge Heraud and Lee Redden in 2011. The company specializes in using machine learning and robotics for agricultural applications, such as weed control and crop management. Acquired by John Deere in 2017 for $305 million.

Although SpaceX was not directly spun out of a university, the underlying technologies and some of the key personnel have strong ties to academic research and institutions.

For a more traditional example of a university spin-off in the space sector, Planet Labs (now simply known as Planet) stands out. Planet, which specializes in Earth observation through a constellation of satellites, was founded by former NASA scientists with connections to Stanford University and other academic institutions. It has grown significantly since its inception, reaching a valuation of over $2 billion after going public via a SPAC (Special Purpose Acquisition Company) merger.

Another notable mention is Rocket Lab, founded by Peter Beck, which has ties to academic and research institutions through its early development and collaboration. While not a traditional university spin-off, Rocket Lab's engagement with the academic community has been crucial to its technology development. Rocket Lab has achieved a multi-billion dollar valuation, becoming one of the most successful companies in the small satellite launch market.

At Space Ambition, we are convinced that venture capitalists have already backed all the low-hanging fruits. Now, humanity faces tougher challenges. Addressing critical issues like climate change or advancing space exploration cannot be achieved through software and AI alone; we need scientists and Deep Tech. Our aim with this article is to motivate you to either start or invest in Deep Tech startups. Naturally, we’d be happy if they were in SpaceTech, but our passion extends to all sectors of Deep Tech. If you know a scientist thinking about startup creation, an entrepreneur aspiring to launch a Deep Tech venture or an investor who is passionate about Deep Tech please share this article with them. We hope it serves as a source of inspiration.