AI in Space Part II: Earth Observation

Investigating how AI is transforming the Earth Observation industry and the potential impact on investment climate.

Space Ambition co-founder Denis Kalyshkin, who has over 10 years of VC experience and an aerospace background, offers consultations for SpaceTech startups investors and corporate clients. Reach out to us at denis@spaceambition.org. We’d be happy to help!

Also, join our WhatsApp community to connect with like-minded subscribers.

Satellites have been in orbit since 1957, but today we are seeing the development of a new, XXI-century generation of satellites, many of which are no bigger than a shoebox. As a result, the number of satellites is increasing dramatically fast – from nearly 3 thousand in 2020 to almost 11 thousand in 2024. These satellites are circling around the Earth and send enormous amounts of data, including imagery of our planet. This data reveals our world in remarkable detail, from the health of crops to the activity in ports. However, the real challenge is that human analysts can’t keep pace, hence much of this data quickly becomes outdated.

Applying automated algorithms, in particular AI and ML, opens many opportunities by enabling us to work with insights almost in real time. As a result, humanity might be able to instantly assess wildfire risk, optimise shipping routes, verify carbon credits, and monitor critical infrastructure.

Market Snapshot

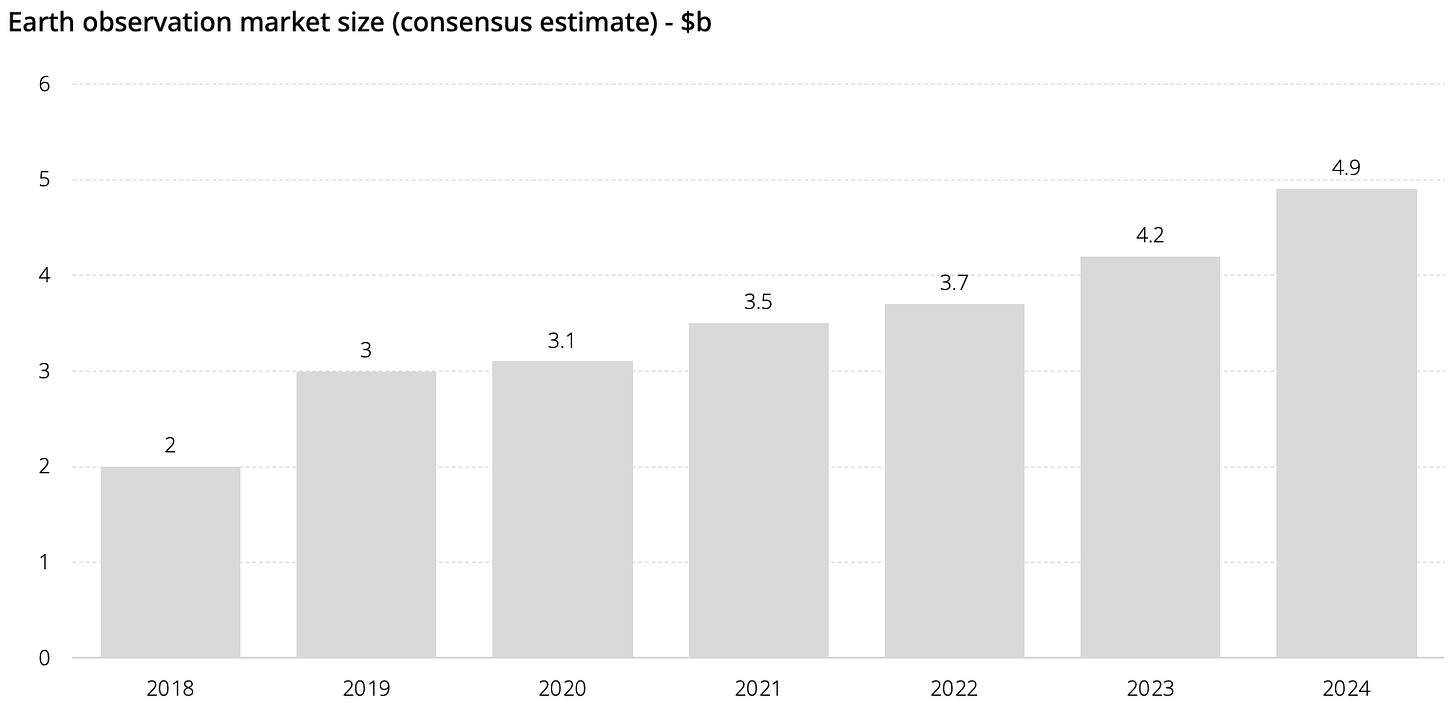

The exact size of the global EO market depends on who you ask, but recent reports indicate a solid growth, the consensus forecast for 2025 indicates a significant $5.3b market size which is nearly a 10% increase from 2024 values. CAGRs projected in the 6% to 8% range for the next 5 years. To confirm the earlier thesis – we're seeing much faster growth in analytics-heavy segments like urban development and synthetic aperture radar (SAR) data analysis with 9% and 8% CAGR respectively, areas where AI is critical.

But where exactly is the AI? Well it isn't just the market for EO data itself, but the value AI unlocks. The World Economic Forum estimated the potential value-added from Earth data analysis at a $266b level in 2023, potentially reaching $700b by 2030. Guess, how significant the impact of AI/ ML is.

What’s Driving The Market?

The real market drivers for AI data analysis in EO are quite obvious and are determined by the state of spacetech economy:

High frequency: near real-time data and significant coverage. For example, BlackSky and Planet’s constellations (by the way we had an article about top EO constellations) can revisit many locations up to 7 times per day. At the same time, almost the entire Earth surface is covered. Customers are able to receive near real time data, enabling additional opportunities.

Pricing: some government-backed satellites provide data for free. Commercial optical imagery might cost under $50 per square kilometer, while SAR data can run into the hundreds. It makes the data much more accessible for the wider audience from indie developers to corporates.

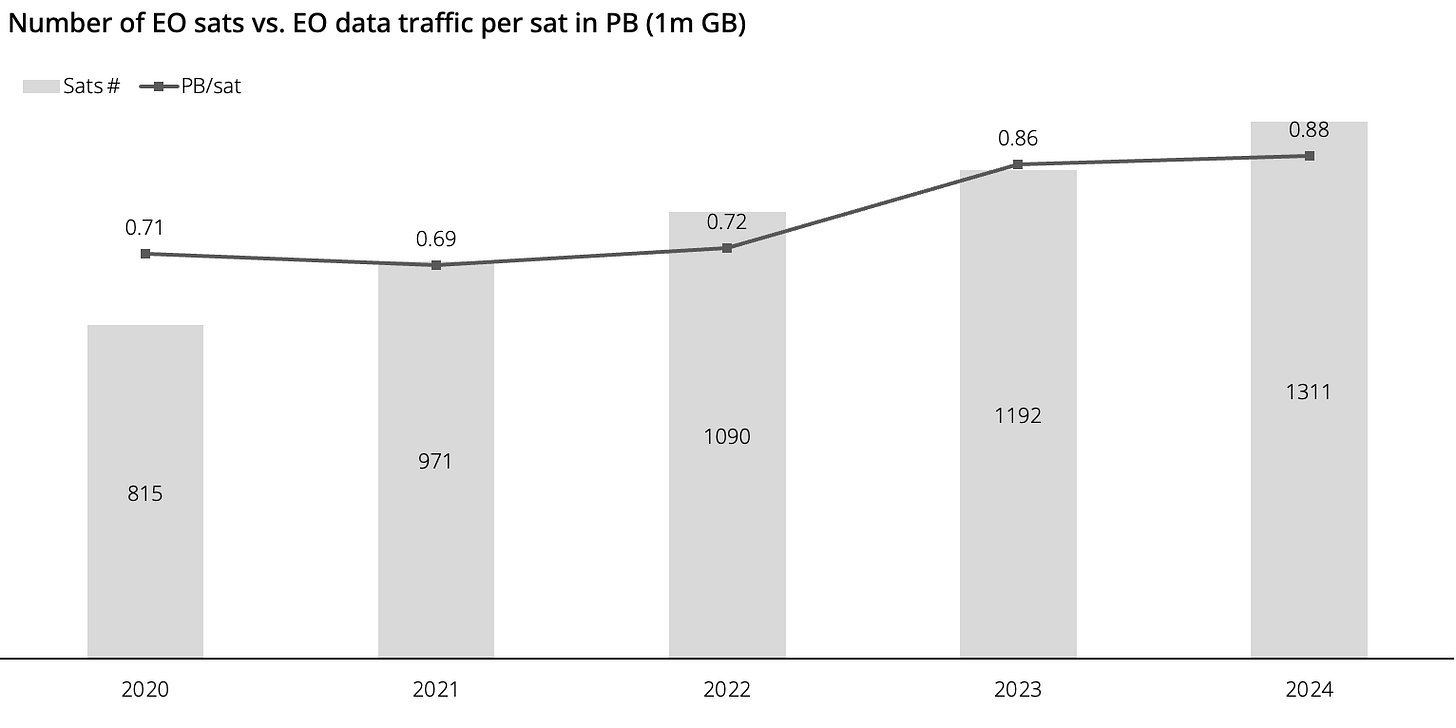

The data: Modern constellations generate terabytes daily. At the same time the average data per satellite is also increasing.

Investment Trends

Despite a so-called VC winter, the global VC investments in spacetech are recovering – growing from ~$7b in 2023 to $8.6b in 2024, while the deal count also increased from 415 in 2023 to 593 in 2024 (Seraphim data).

Seed stage deals have been particularly active, while reaching a Series A remains a struggle for most of the spacetech companies. Average deal sizes fluctuate – Q4 2024 saw a $20m average and $7.7m median while Q1 2024 reported a $22.6m average but a lower $4.4m median, suggesting a mix of large rounds and smaller early-stage deals.

While it might be tricky to isolate AI's share, it’s a driver of the development of the market and attracts VC investments.

The flow of capital follows areas of clear value — investments are concentrating in major clusters around sectors where AI-EO demonstrates feasible benefits:

Climate and ESG: carbon accounting – an emerging method of risk assessment and mitigation.

Agriculture: Improving yields and encouraging sustainable practices.

Defence and Intelligence: Enhanced situational awareness and geospatial intelligence (GEOINT), driven by increased government expenditure.

Insurance and Finance: property risk assessment through AI analysis of imagery.

Infrastructure and Maritime Monitoring: Asset management, supply chain transparency, and risk detection.

Some M&As in the space are highlighting the importance of applying AI to EO. Major non-space companies acquiring startups showcasing a significant advantage of the AI in EO – Moody's (global integrated risk assessment firm) acquired CAPE Analytics in January 2025, EarthDaily (a geospatial analytics company) Analytics acquired Descartes Labs in late October 2024, Privateer (Steve Wozniak's firm, a space data company) acquired Orbital Insight in May 2024.

The AI Engine Room

AI and ML algorithms used in EO are not just a magic wand, it’s an SDK if you’d like, it's a toolbox of techniques. We’ll try to skim through some of the most important ones:

Self-Supervised Learning (SSL). EO archives are significant and mostly consist of unlabeled data. Some SSL techniques, for example, train AI models by hiding parts of an image (or data point) and asking the model to predict the missing pieces. This allows models to learn features directly from the data itself, without the need of manual labeling

Convolutional Neural Nets (CNNs). These algorithms are used to automatically analyze satellite imagery. They are good for detecting patterns, such as land cover types, buildings and objects. These algorithms allow for learning spatial features directly from image data, thus mostly used for classification.

Vision transformers. Moving beyond CNNs, transformer architectures are great for understanding a broader context and specific feature relationships. This is important for analysing complex landscapes over time for example. Computationally intensive.

Data fusions. Data fusions are set to combine different data types. One of the most significant here is Synthetic Aperture Radar (SAR) - optical. While optical sensors provide spectral information, SAR penetrates clouds and darkness, offering structural and textural details. Deep learning algorithms can help enrich one another.

Ensemble learning. This involves combining predictions from multiple models to improve accuracy of analyses. This approach is largely used for tasks like change detection or environmental monitoring, where single models can struggle because of the variability of data.

Synthetic data. While there is plenty of common EO data, we might lack quality rare events imagery (such as disasters). Generative models, like Generative Adversarial Networks (GANs) or potentially diffusion models (remember Stable Diffusion?), can create realistic EO data. This synthetic data can enrich real datasets, impovong the process of AI training.

Edge AI. Instead of sending terabytes down to Earth, edge AI is about inference directly on the satellite. This significantly cuts data transmission costs, enables faster processing and reduces latency. It's tough though – space chips face radiation, power limits, and size constraints – but techniques like model compression and specific hardware are making it feasible

Although this is not a full list, these techniques are commonly used to solve operational headaches in the EO value chain.

Startups to Watch

A new generation of startups is heavily implementing AI in its products. The amount of data is so huge that many startups are focusing less on launching and more on building tech. Here’s a hand-picked list of some use cases and startups representing those:

Natural monitoring. Ocean Ledger is an AI-driven coastal ecosystems monitoring product. Founded in 2023 in the UK, raised ~$1m.

Big data. Datalogy is a product for automated curation of large datasets (including geospatial) to train AI models. Founded in 2023 in the US, raised ~$11m.

Climate intelligence. Chloris Geospatial is a leading AI forest carbon measurement system for carbon stock. Founded in 2020 in the US, raised ~$6m.

Geospatial data analysis. Atlas is a collaborative GIS data analysis platform. Founded in 2021 in Norway, raised $2m.

GIS data. Aino is an AI-powered analysis platform for natural-language querying and applying spatial data. Founded in 2023 in Spain, raised $700k.

Agriculture. AgroGraph is a product for field-level crop health monitoring, early disease alerts and yield forecasting. Founded in 2016 in the US, raised ~$2m.

Disaster monitoring. OroraTech provides real-time natural disaster detection and monitoring solutions. Founded in 2018 in Germany, raised ~$50m.

Insurance. Faura is a property risk assessment solution for insurers. Founded in 2023 in the US, ~$4.5m raised.

Mining and natural resources. TerraEye provides satellite AI-powered solutions for real-time land analytics and monitoring. Founded in 2022 in Poland.

Urban planning. SatVu Deploys is an AI-based heat-data analytics platform for urban and environmental analysis worldwide. Founded in 2016 in the UK, raised ~$80m.

Platform solutions. SkyFi provides intuitive apps for easy access to Earth observation imagery and data and analytics. Founded in 2021 in the US, raised ~$17m.

These companies highlight the trend: AI-first, often fusing multiple data sources, and targeting specific, high-value vertical applications like climate tech, defence, or specialised analytics platforms.

Investor Checklist

For those navigating the EO market, here’s a quick checklist:

Metric: data

Why it matters: data is a new gold, so, like everywhere else, data is significant in building great AI-EO products.

Green flags: diverse sensor access, clear rights, proprietary data beyond public data, partnerships.

Red flags: reliance on public data only, unclear licensing, poor or no quality control.Metric: tech

Why it matters: generic and general AI is often not enough for solving real world problems effectively.

Green flags: advanced techniques, proven benchmarked performance, scalability, proprietary developed approaches, access to compute powers.

Red flags: off-the-shelf and black-box models, "AI washing".Metric: team

Why it matters: the blend of AI, EO/RS, and industry vertical expertise is crucial.

Green flags: relevant PhDs, prior startup/ industry experience, strong engineering background.

Red flags: missing EO/RS or AI expertise, no understanding of customer needs.Metric: go-to-market

Why it matters: “Solving a specific, high-value problem wins”.

Green flags: clear target industry, validated pain point, early traction, vertical integration, workflow automation and embedding.

Red flags: vague market, unproven pain-point.Metric: scalability

Why it matters: scalable solutions are essential in building huge companies.

Green flags: sustainable unit economics, clear pricing, optimising variable (compute) cost vs. revenue.

Red flags: significant portion of manual work, huge service component, unclear pricing, unsustainable compute costs.Metric: revisit/ latency fit

Why it matters: tech must align with market and app needs.

Green flags: latency-revisit-coverage optimised for market needs, edge AI for low latency if required.

Red flags: tech/market mismatch (e.g. using weekly data for disaster response).Metric: regulatory awareness

Why it matters: navigating licenses, privacy, AI regs is critical.

Green flags: proactively addressing compliance (NOAA, EU AI Act), privacy, and ethical concerns, awareness.

Red flags: ignoring regulations, data misuse, lack of transparency.

Your Launchpad

In conclusion, the EO segment is going through quite a transformative period when the integration of AI completely changes the rules of the game. This enables the analysis of tons of satellite data to unlock insights for many diverse industries. This intersection of AI and EO presents significant opportunities for growth, innovation, and investment, particularly in many segments, as startups employ advanced technologies to build various solutions based on satellite data.

So, if you're good with AI and thinking about a space startup, using AI for EO in real industries could be a great path. It's also a good way for tech and general investors to get into space, since these companies are basically AI companies but with satellite data (not an investment recommendation). If you want our thoughts on AI or space tech for your startup, investment fund, or company, drop me an email at nick@spaceambition.org. We're happy to chat.

I would also recommend adding this one to your list. https://geoxanalytics.com/ Property analysis with EO data.